First Quarter 2022 Market Review

Investing During War Time

We’d like to start this update by stressing that we are deeply saddened by what’s occurring in the Russia/Ukraine conflict. The global elite truly believed that if rogue nations like China and Russia were brought into the 21st century global economy, they would eventually become “more like us,” Having been taught the fable of “The Scorpion and the Frog,” we feared they were wrong but hoped they would be right. We hope for a just and lasting resolution and pray for those innocent citizens in both countries who are being so severely impacted.

Why Does Russia Want Ukraine?

No one knows what lies in the heart of Vladimir Putin. But we do know that much of what happens in the world is driven by greed and the lust for power. In past letters, we have noted the friendly alliance between China, Russia and Iran. Despite the internal domestic issues it faces, China has ambitions for international dominance. To achieve regional or world dominance, they will need resources, especially energy and industrial materials.

Iran has oil reserves and Russia has a wealth of natural resources. Russia is a leading producer of coal, diamonds, aluminum, asbestos, gemstones, diamonds, lime, lead, gypsum, iron ore, bauxite, gallium, boron, mica, natural gas, potash, platinum, oil, rare earth metals, pig iron, peat, nitrogen, cadmium, arsenic, magnesium, molybdenum, phosphate, sulfur, titanium sponge, silicon, uranium, tellurium, vanadium, tungsten, cobalt, graphite, silver, vermiculite, selenium, rhenium, copper and gold.

In recent years the country has witnessed mounting challenges in the extraction of its natural resources. Some of the challenges include inadequate capital investment owing to sanctions on the country from major global powers including the United States and Europe due to its involvement in the earlier military incursions into Ukraine (Crimea) and Georgia, as well as shifting investment from industry into military equipment and technology. Additionally, it is difficult to access the country’s mineral resources located in remote areas of its vast territory. China, on the other hand, has plenty of labor and has demonstrated in their Belt & Road initiatives that they are more than willing to export that labor to various regions around the world as well as provide funding for resource development projects in exchange for access to those resources.

Ukraine also has a wide variety of natural resources, mainly energy, metal ores and non-metal ores. The country has approximately 5% of the world’s mineral resources and the world’s 7th largest and Europe’s 2nd largest coal reserves. It also has the largest uranium deposit in Europe and accounts for 1.8% of the world’s uranium deposits. The proven reserves contain an estimated 45,600 tons of uranium. Putting this together, an alliance of China, Russia, and Iran, with Russia in control of Ukrainian resources, has the potential to not only provide all the resources needed to achieve their domestic and global ambitions, but also enough to control the international markets for these critical resources and project a great amount of power and influence over the Eurasian continent.

The Biggest Prize of All?

Ukraine has 300 deposits of graphite, containing more than 1 billion tons or 20% of the world’s graphite. Only China has more graphite reserves (26% of the total world’s graphite reserves). While we think of wood pencils when hearing the word graphite, there are some interesting developments in technology that might make graphite one of the most important minerals in this century when it comes to technological advancements. Graphene, derived from graphite, may be source of technological breakthroughs in everything from microprocessors to energy storage. You can read more about the technology, but the point is that, if the afore-mentioned alliance can gain control of Ukraine, that would give it joint control of nearly 50% of the worlds known graphite reserves.

While the scenario described above is speculative, it makes more sense than the mainstream thinking that Putin, a rational KGB operative by all prior descriptions, is now risking his position and country in the emotional pursuit of regaining the past glory of the U.S.S.R. or imperial Russia by launching land wars across the continent.

The Markets

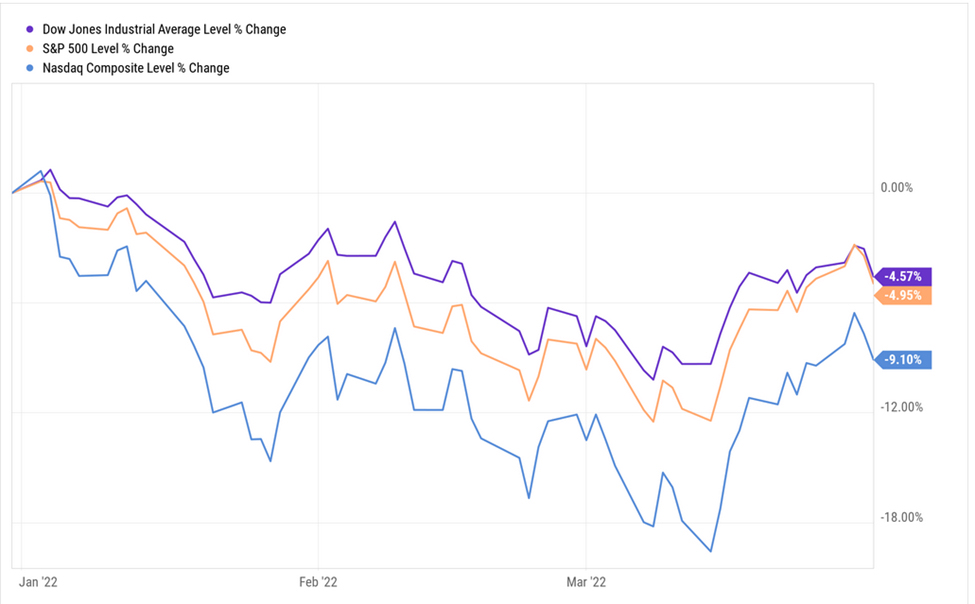

No one likes to see the markets go down in price. As both investors and pragmatists, however, we have been expecting a “healthy” pull back since the beginning of 2021. A year later all three major US indexes suffered their worst quarter since 2020.

Even a moderate 60/40 portfolio made up of the Vanguard Total Stock Market ETF (VTI) and the Vanguard Total Bond Market ETF (BND), ended the quarter down 5.58%. The reason for this has been the drop in value of the bond market as the threat of higher interest rates hurt not only growth stock prices, but also bond prices which are inversely correlated to interest rates. Bond prices have two drivers: duration risk and credit risk. Most bonds and bond funds have been penalized for duration year-to-date because the long rate (10-year Treasury rate) has risen with inflation.

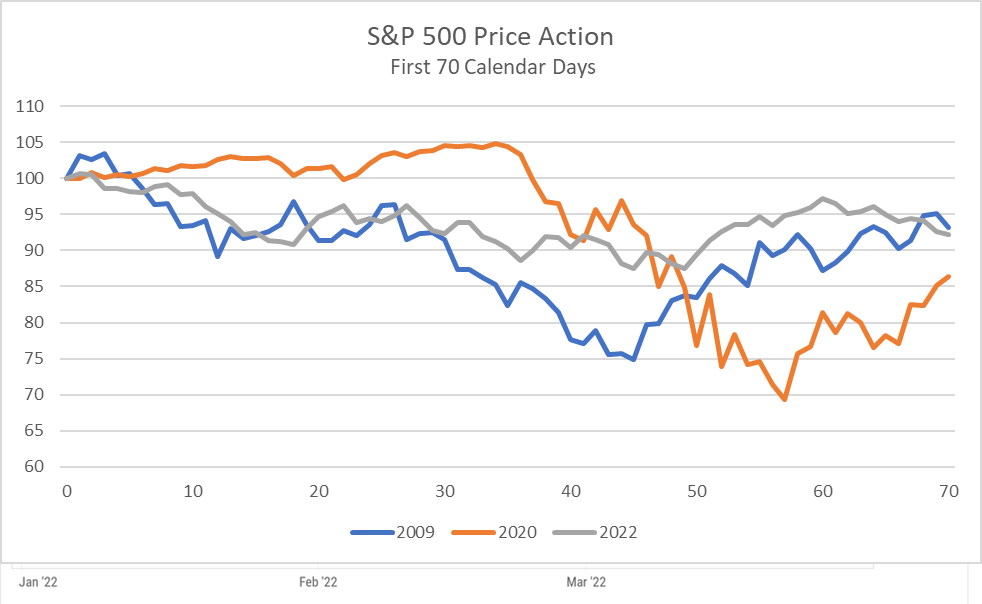

Interestingly, the bottom appears to have formed in March, much like it did in 2020 and 2008.

The backdrop to each year was different and each of the 3 years seems to have its own reasons for having bottomed out at roughly the same point into the year. We are not aware of any common reason for the market’s timing, and therefore, nothing concrete that we can point to that would allow us to predict a March market bottom should we find ourselves in a similar situation in the future.

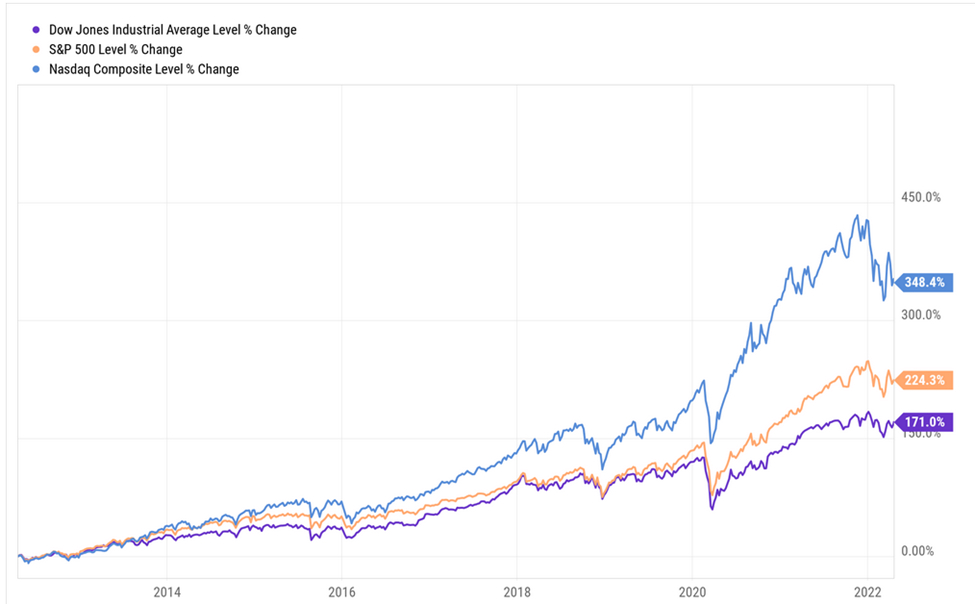

For perspective, even though the pullback was painful to feel in real time, it so far has not inflicted much damage to anyone who remained invested through the volatility as the 10-year chart below illustrates.

Oil or Interest Rates?

Watching the major financial news networks or reading daily market action reports, you might be led to believe that every daily (or even hourly) move up or down has some identifiable catalyst behind it.

These outlets are certainly hoping that you never go back and watch or read their previous reports from months, weeks, or even days ago as you would soon find that the “reason” for the market selling off today was the same “reason” for the market rising earlier.

Instead, there’s much to be gained by studying the great investors of our time like Warren Buffett, Peter Lynch, Howard Marks and Jeff Gundlach, among others, who let their actions and performance do their talking while quietly dispensing their wisdom with little fanfare.

We know it feels like we’ve been talking about the Federal Reserve raising rates for years. In that time, the Fed raised rates only once. Yet today we see the yield on the benchmark 10-Yr Treasury sitting near 2.8% versus 1.6% a year ago. This is the result of the announced change in Fed policy that now seems is being translated into action.

With the pandemic over, inflation is front and center and the Fed has increased its rate hike saber-rattling. The Fed raised its target Fed funds rate by 0.25% last month, its first interest rate hike since 2018. Their updated dot plot projections are calling for six more 0.25% rate hikes in 2022, but the latest comments from Chair Jerome Powell and several other Fed officials suggest the Fed may be even more aggressive with its rate hikes in the near term.

As a result of these comments, the bond market is now pricing in a more aggressive rate hike path than that laid out in the Fed dot plot. Raising rates is the Fed’s most powerful tool for addressing inflation, but is this an inflationary environment?

Nobody needs to be told that prices are rising, we see it every day. Gasoline prices in California have already exceeded $6.00 per gallon and $5.00 per gallon is the norm in many states. And it’s not just gasoline but also consumer staples, including beef, chicken, pork, milk, eggs and bread, are spiking in price. Higher prices are showing up in new and used car prices, rents and housing costs, clothing, entertainment and travel. In a word, it’s everywhere. That much is clear, what is not clear is the root cause of these higher prices.

In our Q1 2021 Client letter, we noted that in economic terminology, inflation is a decrease in the purchasing power of money. And, while it is reflected in a general increase in the price of goods and services, it is caused by a very deliberate action by the Central Bank where they “inflate” the supply of money in the economy by printing more.

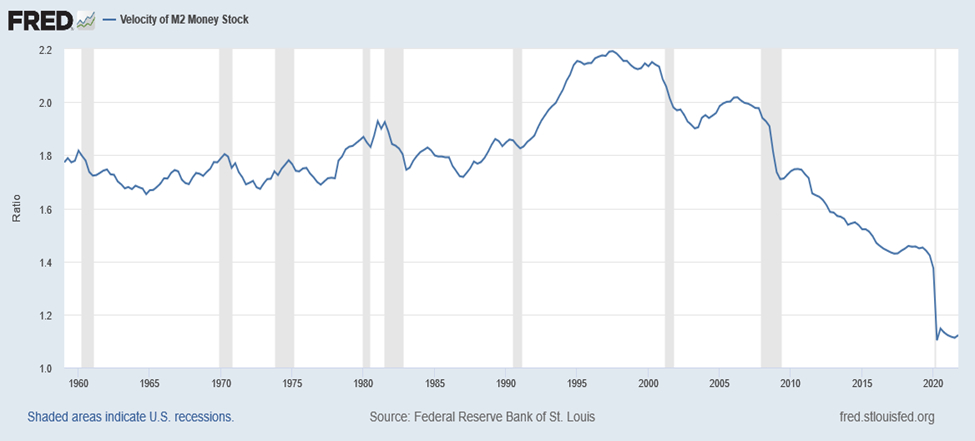

The Fed has printed a boatload of dollars and has been doing so since the 2008 crisis. However, by their own measure, M2 (the velocity of money), those dollars have not made their way to the economy.

Additionally, the US dollar index has risen over the past two months as opposed to weakening.

Higher prices can come from two different directions: demand-pull and cost-push. The differences between them are key to understanding the best course of action.

In a robust, growing economy, usually associated with a rising middle class, the demand for certain goods and services may exceed the capacity for the market to supply them. This can be caused by excess wealth creation as those extra dollars pile up in consumers’ pockets and bank accounts, spurring demand. This can lead to demand-pull inflation. By the basic rule of supply and demand, as the available supply dwindles compared to demand, prices will increase, until the market can adjust its capacity to supply more, and/or prices rise to a level that caps demand.

Cost-push price increases start with the supply side as opposed to the demand side. They can arise from events like embargos, trade sanctions, natural disasters, or logistics bottlenecks. A good example, for those of us “experienced” enough to remember, is the Arab oil embargo of 1974, which sent oil prices from $3.00 per barrel to $12.00 per barrel in a year.

As we wrote in our Q2 2021 Letter, the current administration has made several moves to reduce the production, and therefore the supply, of oil in the US since coming into office. This government action would be considered a cost-push type factor. At that time, we noted that oil futures were indicating a dramatic rise in the price of oil going forward. In our Q3 2021 Letter we showed how oil and natural gas are used in a multitude of goods and services beyond the gas pump, thereby making the point that, as the cost of energy continued to climb, so would the prices of everything that requires energy for production or distribution.

As Michael Shellenberger writes in his book “Apocalypse Never,” a strong economy can only exist when there is access to a reliable, low-cost energy supply. In the absence of such a supply, economic activity will slow or contract until it reaches a steady state with supply. The government could end this problem today if it wanted to, but it prefers to do anything other than what would work. We do not expect this to change in the near term.

Now, cost-push and demand-pull affects are not mutually exclusive, in fact one may lead to the other as consumers, seeing higher prices due to cost-push factors and fearing even higher prices in the future, may choose to spend their money sooner rather than later (demand -pull), which then compounds the problem of rising costs from cost-push influences even further.

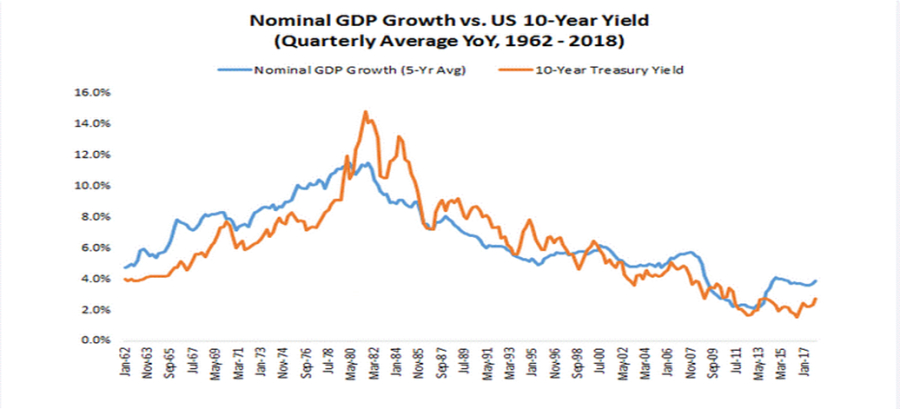

This is important because, as we stated at the beginning, the Federal Reserve, which is made up of a group of economists, mostly from a handful of elite schools, has made the decision to fight inflation, which it will do by raising interest rates. But rising interest rates will exacerbate rising prices as higher interest rates will increase the cost of doing business. And businesses, as they seek to preserve and grow profits, will seek to offset. We see this very clearly in the chart below where, during the 1970’s, raising rates had little impact on cost-push caused price increases (as measured by nominal GDP which doesn’t account for inflation) brought about by elevated energy prices.

It wasn’t until Paul Volcker raised interest rates to the point of collapsing the economy that the situation was reversed as unemployment sky-rocketed thereby reducing demand and finally taming prices.

Since the Federal Reserve is setting out to do the same thing it always does, there is no reason for us to expect a different result this time around and the risk of an economic downturn will increase with every rate hike. Should the Fed decide to go “full Volcker” on us, we would expect the economy to plunge into recession as it has before and for stock prices to follow suit.

What will be different this time is the government’s response to an economic downturn. We have now been conditioned for the “bail out everyone” approach unlike what we saw in the 70’s and early 80’s when unemployment hit 10% and people had to hustle to find work and keep the lights on.

Politicians being who they are, will not hesitate to enact more relief bills which will calm the masses and add a significant increase on our already unsustainable national debt.

Investment Positioning for Stagflation

If you’re in, or heading into retirement, this can be a very unnerving time. There is a strong possibility that the major losers in this environment will be those relying on insurance, annuities, pensions and fixed-rate bonds to pay their bills.

With more interest-rate hikes on the way, the bond market has a rough road ahead. Plus, bond yields still don’t look as attractive compared to the yield you can get from stocks.

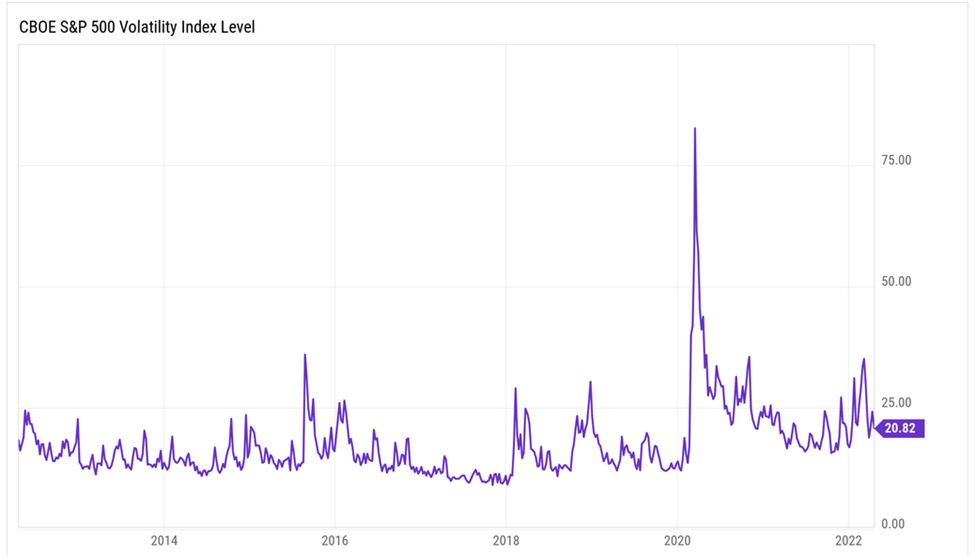

Stocks are volatile right now compared to where they were in the last decade as measured by the Volatility Index or VIX.

Back then Wall Street was counting on the “Fed Put” which had been in place to prevent major drawdowns, but with inflation fears drowning out everything else, many believe that the strategy is no longer in play. This will have the opposite effect on the markets that the accommodative policy did.

Since 2012, just like in the late 1990’s, too many people focused on making quick gains from companies with only a great story but no profits, or even sales. This type of investing was promoted by Wall Street firms that were more than happy to hype weak companies to trusting investors. A myriad of newsletters promised overnight riches with a subscription to their “new secret strategy.” Trust us, if you get one of these solicitations in your inbox, we get 20 of them and it gets worse during extended bull markets.

Meanwhile, successful investors have become wealthy buying boring, well run, mature companies when the opportunity presents itself.

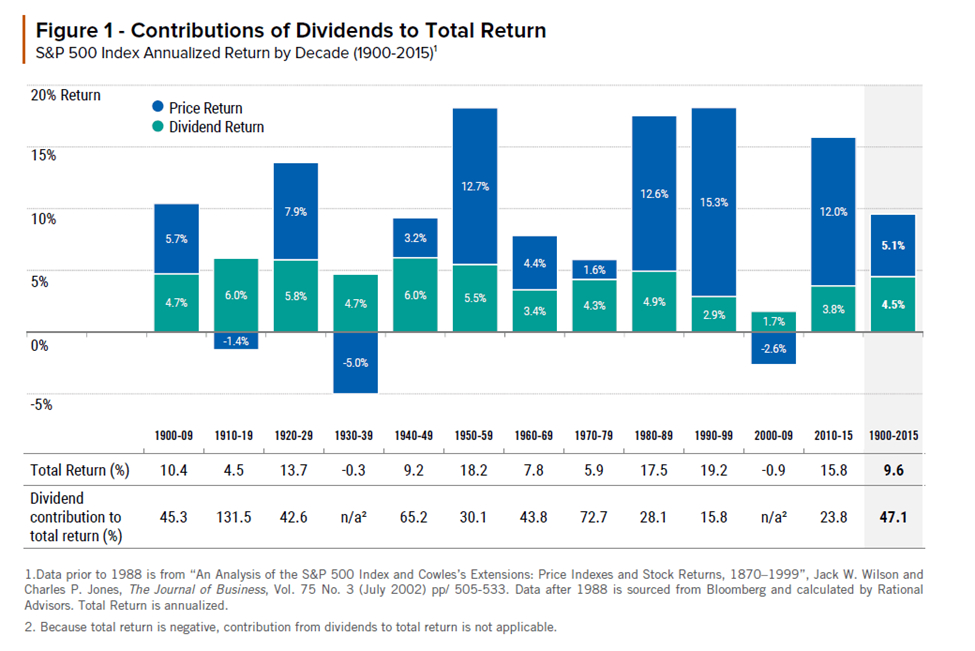

That may not be a sexy way to invest, but it’s a tried-and-true way to become wealthy in the stock market. Dividends have played a crucial role in generating positive returns. Since 1900, dividends have represented nearly 50% of the total return for the S&P 500 Index. Capital appreciation has made up the balance.

Owning dividend stocks is also a defensive tool.

In decades where major financial crises strike, like the 1930s and 2000s, dividends can keep a portfolio afloat.

Besides providing cashflow, companies that increase their dividends year after year often have strong businesses with wide moats. They can hold up well during times of economic stress.

While dividend-paying stocks provide more income than other stocks, they still come with risk. So as yields rise on safe bonds, we could see money shift away from dividend-payers and into bonds. However, it is important to remember that bonds are a fixed income investment, once you purchase one, your income will not increase during the life of the bond.

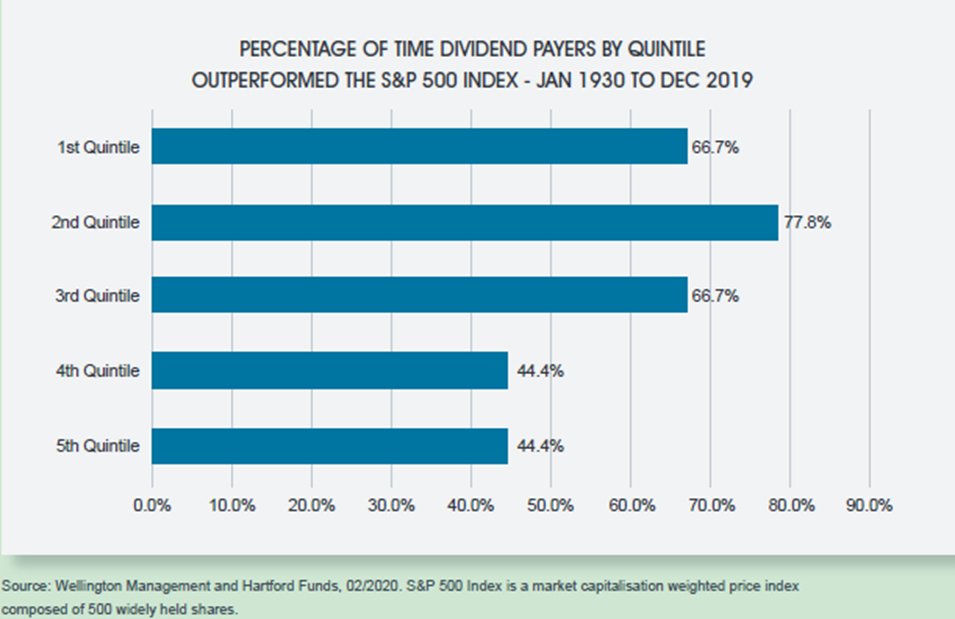

With dividend payers, you have the chance of dividend increases. A quick search reveals multiple stocks that have increased dividends for the past 25 years. Even more surprising was a list of stocks that have paid dividends over the past 100 years. Now some of these companies are in industries that may well go away in the future, but the point is, the approach of building wealth on a foundation of companies that reward their shareholders is a sound strategy. The study below of stocks in the S&P 500 shows that companies in the top 3 quintiles of dividend yield are far more likely to out-perform the index than those in the bottom 2 quintiles.

Now, this does not mean that we abandon growth stocks, but the days where we can buy any growth stock and watch it rise based on pure momentum are over, at least for now. Just like during the end of the dotcom craze, there are companies with growing sales and earnings, either well positioned in the next disruptive sectors or poised to be disruptors in established sectors, that will go through massive changes over the next decade such as the adoption to 5G technology in telecommunication.

The point is, growth is not dead, but it has become a stock-picker’s market as opposed to a momentum market and it will likely be a bumpy ride requiring patience and diligence.

Other investments that may do well in the near future include investments in hard assets such as oil, natural resources, and real estate.

Many of you will notice that your accounts already hold an allocation to many of these assets. For those of you who don’t mind dealing with K1’s at tax time, Master Limited Partnerships (MLP’s) could also do well with elevated energy prices.

While precious metals are always top of mind when discussing inflation hedges, neither gold nor silver yield any income and could be subject to a sell-off when interest rates rise, so we prefer to invest in precious metals through royalty companies that will provide a dividend while correlating with the price of gold over the short term.

The goal is to stay alert to changes in the market and be nimble. That’s what we try to do here at Summit.