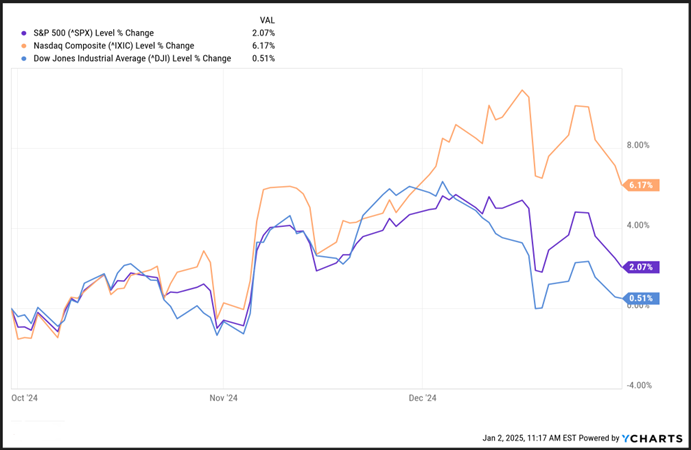

In our Q3 letter, we said we expected to experience volatility in the fourth Quarter. And, just like a broken clock twice a day, we were right. While all three major indices finished up for the quarter, the trend was not smooth, with the Dow Industrials barely finishing above the break-even mark.

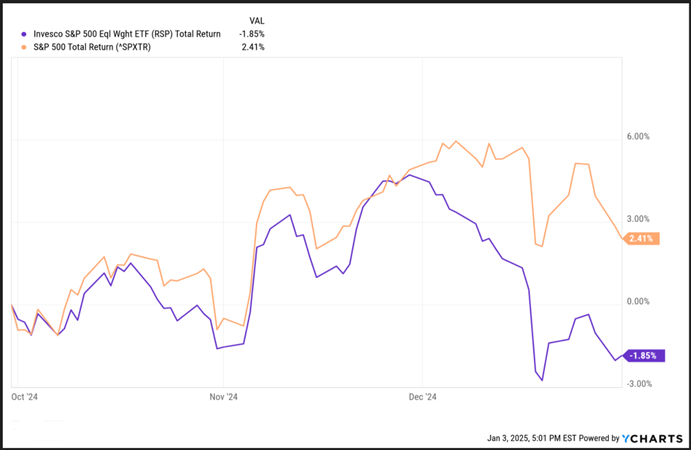

The sell-off in December was more broad-based, as indicated by the equal-weighted S&P 500, which recorded a loss for the quarter.

This means that a relative handful of stocks once again buoyed the cap-weighted index. The index held up well until the last Federal Reserve meeting on December 16th-17th, when the Fed cut the Federal Funds Rate by another quarter of a percentage point but signaled the possibility of fewer rate cuts in 2025 than the market was anticipating.

As we have pointed out before, markets are forward-looking, and prices today reflect an outlook between nine and twelve months into the future. When the outlook assumes, for example, four rate cuts in 2025 and the Fed indicates it could be less, then prices are going to recalibrate based on the new information. This is, again, why short-term trading is so challenging and not recommended as a wealth-building strategy.

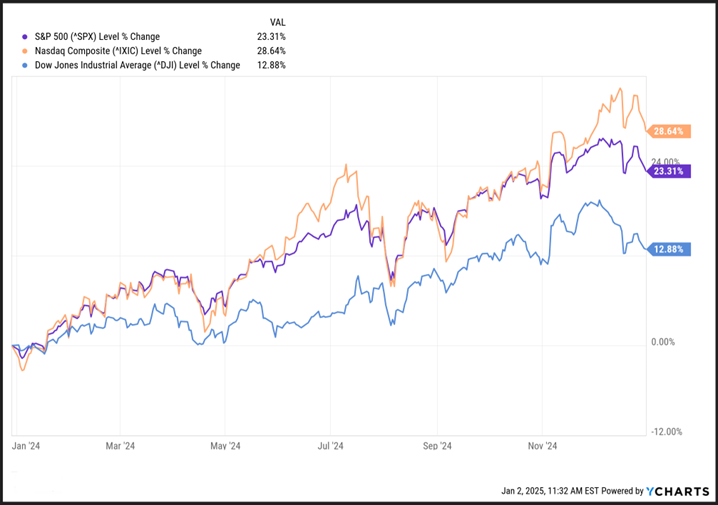

For the year, all three indices finished in positive territory, with the S&P 500 and the Nasdaq Composite both closing well above their historical averages.

While we are always happy to see large gains in the markets, it is important to emphasize that these returns are well above average, and in the long term, the markets will always revert to the mean. Often, these mean reversions can be violent, with drawdowns in excess of 30% in some cases. Other times, they can be less volatile but excruciatingly long.

While AI (and bitcoin) have generated a lot of excitement, significant headwinds could cause the market to stall or even correct in the next twelve months.

Inflation, Interest Rates and Fed Policy

Last year was a rollercoaster of predictions, ranging from 0 cuts to 7 cuts at different points depending on crucial data points around inflation, GDP growth, and the labor market. The markets reacted or overreacted to every new report. We ended with 3 cuts and the markets are already placing bets for 2025. We don’t know how many times the Fed will cut rates or where yields will inevitably land by the end of 2025, and even if we thought we did, many dynamics are in play that can derail any outlook or prediction.

Private Sector Job Growth

Over the last four years, the greatest job growth has been in the government sector. In 2023 alone, government employment rose by 709,000 jobs, surpassing the growth seen in 2022 and 2021. This trend highlights a significant reliance on public sector employment to sustain economic growth, with nearly 25% of all job gains in 2023 attributed to government positions. Over-reliance on government job growth can lead to significant market distortions. When the government becomes the primary employer, it can create an imbalance in the labor market, leading to inefficiencies and reduced competitiveness. This can result in a misallocation of resources, where talent and capital are drawn away from potentially more productive private sector opportunities.

Additionally, government jobs are funded by taxpayer money, which can strain public finances and lead to higher taxes or increased public debt. This reliance can also stifle innovation and entrepreneurship, as individuals may prefer the stability of government employment over the risks associated with starting or working in private enterprises.

Private sector job growth, particularly outside the service sector, will be critical to drive ongoing economic strength. Diversifying job growth into manufacturing, technology, and the energy sector can create a more resilient and dynamic economy. Employment growth in these sectors often leads to higher productivity, better wages, and sustainable economic development and usually results in higher corporate earnings, which in turn drives up stock prices. A more balanced distribution of economic activity helps to mitigate the risks associated with economic downturns and contributes to more market stability.

US credit card defaults soar to highest level in 14 years

According to a report from the Financial Times citing data analyzed by BankRegData, lenders wrote off more than $46 billion in seriously delinquent credit card loans during the first nine months of 2024. That’s an increase of 50% from the first three quarters of 2023 and the highest since 2010. Not only does this drive higher borrowing costs for everyone but it hurts earnings and may be a warning for other areas including auto loans and mortgages.

As living costs rose post-Covid, many consumers either could not, or refused to cut their spending. In many cases, spending was maintained via credit card debt. As the data above shows, this is not sustainable and even though the rate of price increases has slowed, prices are not going to come down, meaning it will be a while until real wages can catch up (if they ever do). That likely means a smaller spending allocation to non-essential items and could impact nearly everything from consumer electronics and auto sales to dining and travel. In fact, we could already be seeing the impact as..

…US retail closures hit highest level since pandemic

Coresight tracked 43 retail bankruptcies in 2024, a sharp increase from the 25 bankruptcies recorded in 2023. Retail bankruptcies can have several negative impacts on the economy. They can lead to significant job losses, reducing consumer spending power which can further strain other businesses, creating a ripple effect throughout the economy. Additionally, the closure of retail stores can leave commercial spaces vacant, leading to decreased property values and reduced tax revenues for local governments. Economic sentiment can also be dampened, as frequent bankruptcies may signal underlying economic weaknesses and reduce consumer and investor confidence.

Retail stocks may experience significant declines, affecting the portfolios of investors and potentially leading to broader market sell-offs.

The commercial mortgage-backed securities (CMBS) market, which includes loans backed by retail properties, may also be impacted, with increased delinquency rates and special servicing rates, creating additional stress on financial institutions and investors holding these securities.

Debt rollovers from low interest rates to high

Many companies are facing the challenge of rolling over their debt from ultra-low interest rates to significantly higher ones. When interest rates were low, firms used cheap credit to finance expansion and operations, often locking in long-term debt at favorable rates. These companies now face higher costs when refinancing their maturing debt. Increased borrowing costs can squeeze profit margins, as more revenue must be allocated to interest payments, leaving less available for reinvestment and growth.

FactSet noted in a recent article that

106 S&P 500 companies have issued quarterly EPS guidance for the fourth quarter. Of these companies, 71 have issued negative EPS guidance, and 35 have issued positive EPS guidance.

They note that this is above the 5-year average of 56 and above the 10-year average of 62. It also marks the fifth time in the past eight quarters that more than 70 S&P 500 companies have issued negative EPS guidance. Of the 11 sectors, the information technology, Industrials, and Consumer Discretionary sectors have the highest number of companies issuing negative EPS guidance.

The impact on earnings and growth prospects is particularly pronounced for smaller firms, which are considered the economy’s growth engine. Due to the increased financial burden, these companies may struggle to maintain their previous levels of investment and expansion.

War

The ongoing wars in Ukraine and the Middle East could significantly impact the U.S. stock markets in 2025 by increasing volatility and uncertainty. The conflict in Ukraine has already disrupted global supply chains, particularly in energy and agriculture, leading to higher prices and inflation. This, combined with potential sanctions and geopolitical tensions, could create a risk-averse environment where investors might pull back from equities and seek safer assets like bonds or gold. Additionally, the Middle East conflict, especially if it involves key oil-producing nations, could lead to spikes in oil prices, further exacerbating inflation and impacting corporate profits.

Historically, geopolitical shocks have led to short-term market sell-offs, but as we saw with Iraq and Afghanistan, the extent of the impact depends on the duration and severity of the conflicts. Certainly, if these wars escalate, the uncertainty could dampen investor sentiment and slow economic growth, leading to a more sustained downturn in the stock markets.

Cybersecurity

The increase in cyber-attacks at both the government and personal levels could significantly rattle the U.S. stock markets in 2025 by heightening uncertainty and undermining investor confidence.

Government-level cyber-attacks, especially those targeting critical infrastructure or financial institutions, could disrupt market operations, leading to delays in trading, data breaches, and potential financial losses. Such incidents could trigger panic selling and a flight to safer assets, causing sharp declines in stock prices. Additionally, the fear of further attacks could increase volatility as investors react to news and rumors of potential threats.

On a personal level, widespread cyber-attacks affecting individual investors and consumers could also have a destabilizing effect on the markets. If many people experience identity theft, financial fraud, or personal data breaches, trust in digital financial systems could be eroded, and consumer spending could be reduced, again impacting corporate earnings and economic growth.

Just recently, we have been alerted that there is an active phishing text campaign (smishing) in which Schwab clients receive a text message from an international number mentioning a disbursement from their account. The message then asks users to click on a link to log into their account and verify the transaction.

Please review the red flags below to help you identify if the text is a phishing attempt:

- The texts come from different international phone numbers.

- The texts notify that an ACH was debited from your Schwab (or other) account, typically in the thousands of dollars.

- The text then instructs you to cancel the disbursement if you did not request it, by replying “Y” and clicking on the link provided.

- The link’s URL is a variation of a spoofed Schwab (or other) domain, such as https://schwbba.com, https://schwabd.com, or https://schwbab.com.

Note:

- Schwab does not notify clients about completed transactions via text message.

- Schwab does not send out text messages from international numbers.

Remember: Unlike many other attacks, smishing isn’t necessarily an indication that your account has been compromised—the attackers send a message to many randomly chosen phone numbers, hoping some of those people will respond.

- Do not click on links or attachments included in a text message.

- Slow down if a message is urgent. Urgent account updates and limited time offers are red flags of possible smishing. Remain skeptical and proceed with caution.

- Avoid using links or contact information from the message. Go directly to the official channels/websites.

- Double-check the phone number. Scammers use international numbers or odd-looking numbers, such as 4-digit phone numbers, to mask their true phone numbers.

- Never enter your account credentials or other personal information via an unverified link. Instead, enter your familiar address directly into your browser to visit the trusted website and log in as usual.

- Double-check that the URL is not a subtle variation of the real one.

- Do not call phone numbers received through unsolicited messages. Always use a verified number that you have used in the past or is found on your account statement.

Deficit Spending

In 2019 the federal deficit was just under $1 Trillion. Now interest on the debt is $1.1 Trillion.

We’ve all heard this before, and in truth, the US federal government has historically been addicted to overspending. Looking at data over the 119 years from 1901 to 2018, we have had a federal budget deficit 89 times (75% of the time), and a surplus only 30 times (25%). The time for an easy course correction has likely passed, it’s just too politically difficult for Congress to stop endlessly piling on more debt.

As the federal debt increases, the government must issue more Treasury securities to finance it, which can lead to higher interest rates. Higher interest rates make borrowing more expensive for businesses and consumers, potentially slowing economic growth and reducing corporate profits. Additionally, if investors lose confidence in the government’s ability to manage its debt, it could lead to a decline in the value of the US dollar, impacting global markets and investment portfolios.

This suggests that we should continue to expect volatility in equity and fixed-income markets for the foreseeable future.

So, what do we do then? We don’t speculate; we prepare.

Every investment should have a purpose: to grow your wealth, protect your wealth, derive income from your wealth, or act as a store of wealth. When we clearly understand our financial horizon, we can allocate our investments to handle short-term emergencies, pay for near-term financial obligations, and build long-term wealth.

Money needed for emergencies or that you plan to use within the next two years should be kept in cash or liquid cash equivalents. No investment can reliably ensure that you’ll earn your money back over such a short time frame.

Bond ladders work well for money you’ll need in two to five years. While bonds offer lower returns than stocks, they’re better at protecting value over a five-year period.

Historically, stocks are the best asset class for wealth generation, especially if you stay invested for at least a decade. The longer the time horizon, the clearer the advantage.

And when we invest in stocks, we look for great businesses that have pricing power, consistently grow their sales and earnings year after year and have great management teams that allocate their profits for the business’s long-term health. When we can buy these companies at a reasonable price, we do so, and if their prices fall due to a market correction, we buy more or at least reinvest the dividends if the company pays one. Our favorite valuation metric is Cash Flow Return on Investment (CFROI), which is at the core of most of our strategies.

If we follow this simple allocation/investment strategy, we can sleep well through the short-term market ups and downs and even get a little greedy when the market puts our favorite companies “on sale.”

New 401(k) Changes for 2025

For 2025, contribution limits are increasing across different age brackets. Americans under 50 can save up to $23,500 in their 401(k)s, an increase of $500 from 2024.

Those aged 50 to 59 can contribute an additional “catch up” amount of $7500, bringing their total limit to $31,000.

For those aged 60 to 63, the IRS recently announced that these individuals will be allowed to contribute an additional $11,500 on top of the regular 401(k) contribution limits, bringing the total 401(k) contribution potential to $34,750 annually. The higher cap for individuals between 60 and 63 is the largest 401(k) rule adjustment in 20 years.

Changes are also being applied to similar retirement savings plans. For 403(b) and Thrift Savings Plan participants, the annual contribution limit will increase to $23,500 in 2025.

However, some limits remain unchanged, such as the annual contribution cap for Individual Retirement Accounts (IRAs), which holds steady at $7,000 with an additional $1,000 catch-up for those 50 and older.

Standard Deduction Adjustments

In addition to retirement savings adjustments, the IRS announced higher standard deductions for 2025. Single filers will have a standard deduction of $15,000, married couples filing jointly can deduct $30,000, and heads of households are eligible for a $22,500 deduction.

Happy Retirement!

We couldn’t finish this letter without a brief word about our friend and colleague Tom Czech who announced his retirement last fall. Tom joined his friend Marv Swentkofske at Summit in 1991, after serving as First Vice President and Investment Strategist for Blunt, Ellis and Loewi/Kemper Securities.

While he doesn’t get the credit he deserves, Tom was one of the first adaptors of computerized trading systems, which had been the property of private hedge funds and very large wealth management institutions. He created the fundamental and technical criteria for finding the best stocks to buy and wrote the computing code, creating a proprietary system that is still in use today. Tom served as president until 2019 and continued to be a trusted advisor for his clients before deciding it was time to spend more time with friends and family.

Even though he won’t be working as an advisor anymore, he will remain a very active and interested client. Investing is a passion for Tom, and he loves to engage with and share ideas and information about the subject. We look forward to the ongoing relationship, and we wish him the happy and healthy retirement he so richly deserves!

As always, we appreciate your business and trust in us to be with you on your financial journey. We celebrated several client retirements in 2024 and look forward to more celebrations in the years to come. This is what makes the business fun and worthwhile, and we are grateful that we’re allowed to do this every day.