Expecting More Volatility

The broad market indices all finished the quarter positively, bolstered by a 0.50% cut in the overnight lending rate by the Federal Reserve.

The market was led by the Dow Jones Industrial Average, while the Nasdaq Composite struggled to stay above the water line. More importantly, the Equal Weighted S&P 500 index outperformed the market-cap weighted index, which had been driven by the “Magnificent 7.”

This indicates to us that positive momentum is more broad-based than it had been recently, and investors are buying stocks instead of chasing memes. Typically, under these conditions, the rally is likely to continue, and our individual account valuations should more closely match the index performances.

The Fed lowered its overnight lending rate to a range of 4.75%-5.00% from 5.25%-5.50% and forecast another “50 basis points” in cuts this year and a further 50 bps next year (50 basis points = 50 bps = 0.50%). Previously, the Fed was looking for a reduction of 125 bps for 2024.

They now see rates at 4.40% at the end of 2024, and 3.40% in 2025.

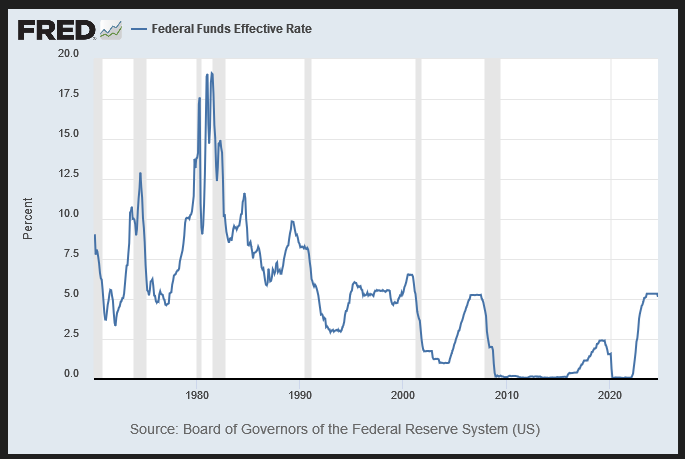

While a rate cut wasn’t surprising, the size of the rate cut was. Since the 1980’s, the Federal Reserve has cut rates by 50 basis points only during times of potential economic distress:

- 1990-1992: The Gulf War Recession

- 2001: The Dot-Com Bust and 9/11

- 2002-2003: Flagging Recovery, Low Inflation

- 2007-2008: The Housing Market Crash

- 2008: The Great Recession

- 2020: The Covid-19 Shutdown

Looking at the most recent economic data, the Atlanta Fed lifted its Q3 GDP estimate from 2.9% to 3.1%, indicating continued strength despite the current interest rate environment.

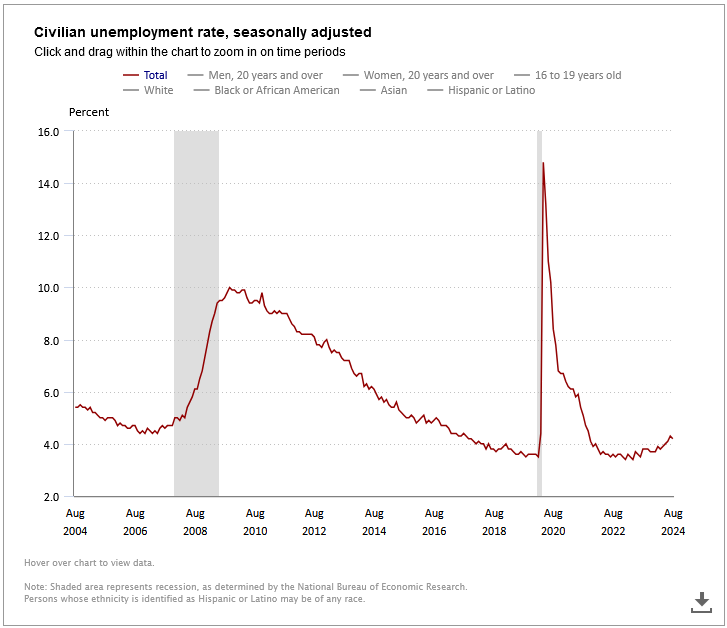

While softening a bit, the official Civilian unemployment rate is still hovering around a historically low 4%.

On the flip side, The Fed’s favorite inflation indicator, Core PCE, rose less than expected on a month over month basis (+0.1% actual vs +0.2% expected), but on a year over year basis, Core PCE rose from 2.6% to 2.7%, in line with expectations and the highest since April. The so-called SuperCore PCE, which excludes food, energy and housing prices, re-accelerated in August to +3.29% year over year.

So, at a time when there is NO systemic problem, GDP is 3% or better, employment growth is adequate, and we are still dealing with persistent inflation, a large rate cut does not seem warranted.

Federal Reserve interest rate policies are described as being either neutral, accommodative, or restrictive. Where:

- Neutral Policy: Is used during stable economic conditions to maintain steady growth.

- Accommodative Policy: Is used during economic slowdowns to stimulate growth.

- Restrictive Policy: Is used during periods of high inflation to cool down the economy.

Looking at a chart of the Fed Funds Rate versus recessions, it is difficult to determine where one policy ends and the others begin. This leads us to believe that the Fed Governors don’t know which type of policy they’re pursuing until they see its impact on the economic numbers.

Regardless, history shows that the beginning of a rate-cutting cycle results in average gains of about 16% in the 12 months following the first Fed rate cut according to data from Canaccord Genuity.

August Swoon – A Tale of Two Catalysts

While July started with promise, by August we were almost in correction territory with several down days to start the month.

If you watch or listen to the major financial networks (not recommended), the explanation was that tech earnings were disappointing, and there were red flags in the US labor market that could indicate a serious slowdown was taking place. The economic data was putting the chances of a rate cut at risk and the markets were repricing with every data point. However, if you dug a little deeper, many credible market analysts were pointing to a popular, high-level trading strategy that suddenly stopped working: the “yen carry trade.”

Imagine you can borrow money at a very low interest rate, and then invest that money in assets that could provide a higher return. For years, interest rates in Japan have been very low, sometimes close to zero. This makes borrowing Japanese yen (¥) very cheap. Traders could then convert the yen into another currency, like US dollars ($), and invest in dollar-denominated assets offering a higher return, profiting from the difference.

The yen carry trade is popular because it can be quite profitable. If the interest rate in Japan is 0.1% and in the US it’s 5%, the difference (4.9%) offers a nice profit margin.

In the last four years, Japan was the only major economy in the world offering essentially free money. While the US, Europe and others were raising interest rates to fight inflation, Japan has been battling against deflation by keeping its borrowing rates low to encourage economic growth.

However, this trading strategy does carry risks:

- Currency Fluctuations: If the value of the yen increases, investors will need more dollars to repay their yen loans, which can lead to losses.

- Interest Rate Changes: If Japan raises its interest rates or the US lowers theirs, the profit margin shrinks or disappears.

Looking at the chart below, you can see the relationship between the yen and the dollar reversed at almost the same time as when we saw the major indices begin to head downward.

The Bank of Japan raised interest rates for the second time since March, pushing the yen even higher, making it more expensive to pay back yen-based loans.

Meanwhile, the dollar weakened as the Federal Reserve strongly hinted at looming rate cuts, and US tech stocks declined.

When individual investors make these trades, they may suffer severe losses, but it would have no impact on the overall markets. However, large institutional investors and hedge funds make these trades with trillions of dollars at stake and when they suffer losses, the impact is felt in our accounts as well as theirs. And since they are borrowing funds, these are leveraged trades, and the impact is magnified.

By all estimates, the yen carry trade is only 50% unwound, and the risk of more volatility continues to hang over the markets as these large institutions scramble to avoid substantial losses. There is a more recent article about it that you can read if you’d like to know more.

The Election

Do elections even matter?

On a personal level, we believe the answer is yes. Elections have resulted in a multitude of Fiscal changes including:

- The Income Tax (1913)

- The Federal Reserve (1913)

- The 17th Amendment (1913)

- The New Deal (1933)

- The Great Society (1964)

- The Abandonment of the Gold Standard (1971)

- Student Loan Reform (1993)

- The Patriot Act (2001)

- The Affordable Care Act (2010)

- The Inflation Reduction Act (2021)

- The CHIPS Act (2021)

Many of these actions have resulted in a mind-numbing proliferation of “Alphabet Agencies” and associated departments that can no longer fit on one web page. Certainly, we have all been impacted, positively or negatively, by at least one item on the list, so in that regard, elections do matter.

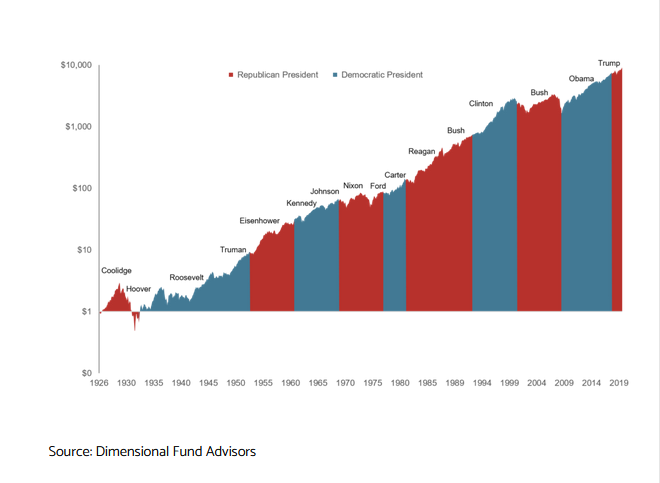

However, when it comes to our investments, the answer so far seems to be “No, they don’t.”

The chart below is from a study published by Dimensional Fund Advisors that determined that presidential elections have not had a significant impact on market returns. Looking at returns since 1926, anyone trading in or out of the market based on who was in office would have missed significant gains.

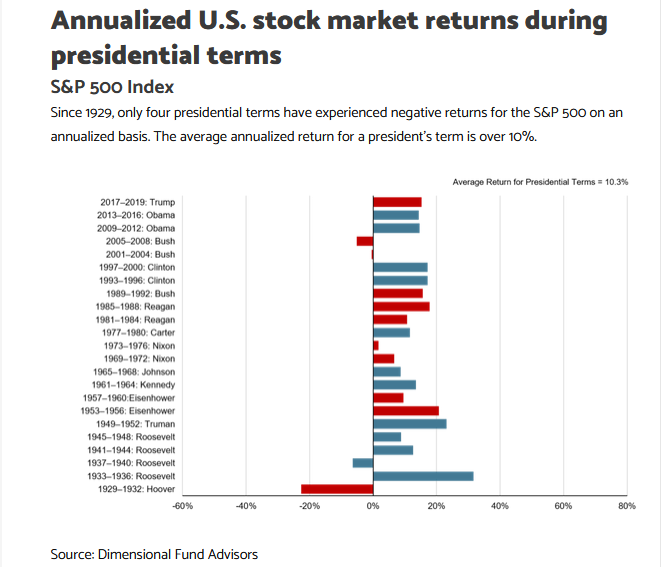

In fact, as indicated in the graph below from the same study, only four times since 1929 has a four-year presidential term resulted in negative market returns and the average gain per presidential term is over 10%.

Moreover, their analysis of Congressional elections (midterm and presidential) and annual returns, shows no pattern of stronger returns when a specific party is in control of Congress or when there is mixed control. Markets have historically continued to provide returns over the long run, regardless of which party is in power.

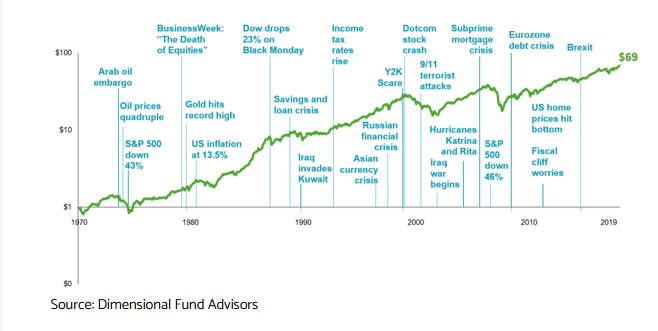

The chart below was made before the COVID-19 pandemic, however, we all know how the markets have recovered since the March 2020 lows. What it indicates is that even though a natural or human-caused disaster may seem like a major crisis, none of the events listed below had a significant impact on the market’s long-term performance. We should perhaps change the definition of the word “crisis” or find a different word to use when naming these occurrences, at least when it comes to the stock market.

To emphasize that last point, a study published by Winthrope Wealth analyzing S&P 500 returns from 1928 to May 2019 found that 93% of the 978 rolling ten-year periods produced positive returns. This means that if you were to hold through a ten-year period, the likelihood of positive returns is very high.

The reason for this is pretty simple and was the focus of a talk we gave earlier this year at an investment conference. Despite whom is in office, there are investment themes that are inevitable and transcend politics:

- Illness and disease

- The human desire to innovate and improve the world

- Constantly changing demographics

- Fear, greed, and scarcity

- The need for energy to power our lives

- War and aggression

Our job as investment managers is to follow the trends and to invest in those companies best suited to profit from them regardless of who is in office.

Our job as financial advisors is to understand your financial situation and to position your investments so they are always aligned with your short and long-term needs and not worry about who won or lost, or is about to win or lose.

This is our commitment to you and we come to work each day doing our best to uphold that commitment.

One final note, we are pleased to be adding Sterling Foundation Management, LLC to our list of Pinnacle Service Providers. In addition to the traditional Philanthropy Services for charitable programs, they provide a wide and growing variety of optimized, proven, solutions to a wide variety of client situations and problems including:

- Selling A Business

- Appreciated Real Estate

- Large Retirement Plans

- Concentrated Stock Position

- We are happy to welcome them into our network and look forward to working with them when their expertise is required.

As always, it is an honor and a pleasure to work with you in pursuit of your aspirations and we encourage you to contact us and keep us updated when any major changes take place.