Santa Claus finally Came to Town!

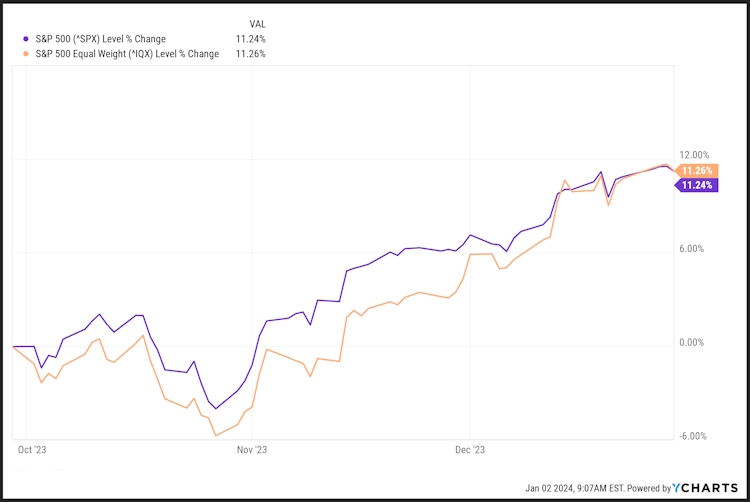

Although all three of the major indices closed down on December 29th, they ended the quarter substantially higher than where they started.

For the year, they all ended up with the Nasdaq leading the way, although there was a speed bump in the third quarter.

Even our favorite comparative benchmark, the S&P Equal Weighted Index, finally showed signs of life by finishing the quarter essentially even with its mega-cap weighted cousin.

Most of these gains were fueled by a “consensus” that the Fed will begin cutting interest rates in 2024 and that the earnings recession is over.

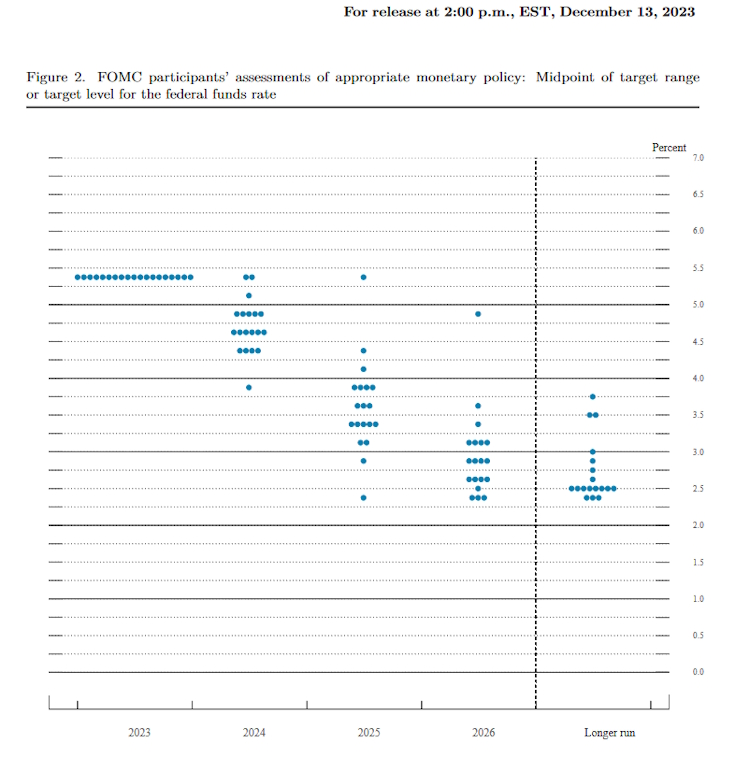

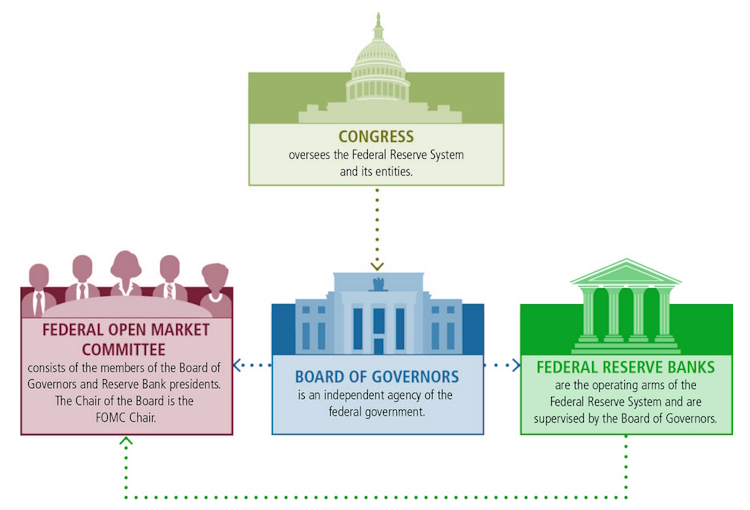

Regarding the first point, as we have written in the past, the Fed publishes the predictions of the 19 members of its Federal Open Market Committee (FOMC) four times a year. These predictions are commonly displayed via a dot plot where each dot represents a FOMC member’s prediction of the Fed Funds Rate at the end of each calendar year. Here is the plot from the December FOMC Meeting:

What this is showing is that by the end of 2024, most of the members believe interest rates will be between 4.25 and 5% which, although slightly lower than the current rate, would still align with Chairman Powell’s “higher for longer” comments.

Looking further out, most of the central bankers believe that rates will drop below 4% in 2025 and below 3% in 2026.

The 10 Yr. Treasury Yields have already come down below 4% in response to the Fed meeting after peaking near 5% in October.

10 Year Treasury Rate Historical Chart Source: MacroTrends.net

Since these predictions are supposed to be based on each member’s expectations for inflation and the economy, expectations of these dramatic rate cuts suggest that the FOMC members are anticipating either a substantial downturn in economic activity, a substantial drop in the rate of inflation, or a combination of the two. While we would assume that a slowing economy would mean a further drop in the rate of inflation, history shows that the two aren’t always perfectly correlated.

According to FactSet’s Earnings Insight Report:

For Q4 2023, the estimated (year-over-year) earnings growth rate for the S&P 500 is 2.4%.

If 2.4% is the actual growth rate for the quarter, it will mark the second straight quarter of year-over-year earnings growth for the index (emphasis ours).

Still, as of December 15th they report that:

For Q4 2023, 72 S&P 500 companies have issued negative EPS guidance and 39 S&P 500 companies have issued positive EPS guidance.

This tells us that all is not rosy across the economy as some sectors will experience continued growth while others continue to struggle under the current business conditions.

While many experts expect positive returns for stocks in general for 2024, most agree that the biggest threat to solid returns in 2024 is the risk of recession with some financial pundits wondering out loud why we aren’t already in one.

Where’s the Recession?

The Yield Curve has been inverted since July of 2022 and “typically” it has taken between six to twelve months after inversion for a downturn to occur. Heading into 2024, the curve is still inverted as measured by the 2Y / 10Y Yields.

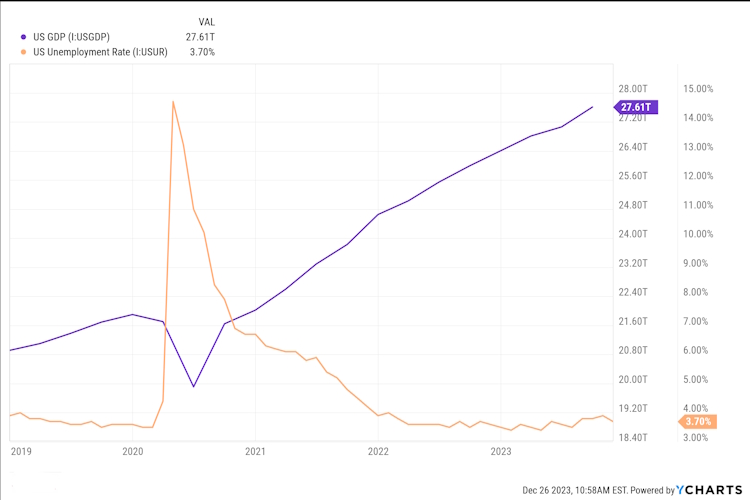

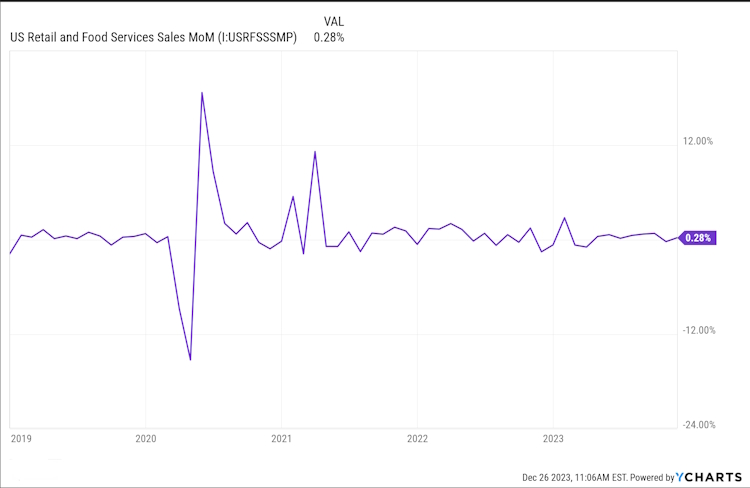

Yet there are still no signs of slowdown in the government’s favored economic metrics such as GDP, Labor Markets, and Retail Sales / Consumer Spending and Income.

Could this be the “Soft Landing” everyone has hoped for? As reported in Forbes:

Throughout the first half of 2023, Bank of America economist Michael Gapen had been calling for a recession, but recent economic data changed his mind.

“We revise our outlook for the U.S. economy in favor of a soft landing, where growth falls below trend in 2024 but remains positive throughout our forecast horizon,” Gapen said in August.

Bank of America is the second largest bank in the U.S. after Chase, so one would assume that their economists have a good idea of what’s happening in the economy.

Fed Chair Jerome Powell said during the FOMC’s post-meeting news conference in September that he’s always thought a soft landing “was a plausible outcome—that there was a path.” He told reporters: “I do think it’s possible.”

Still there are warning signs that should not be ignored.

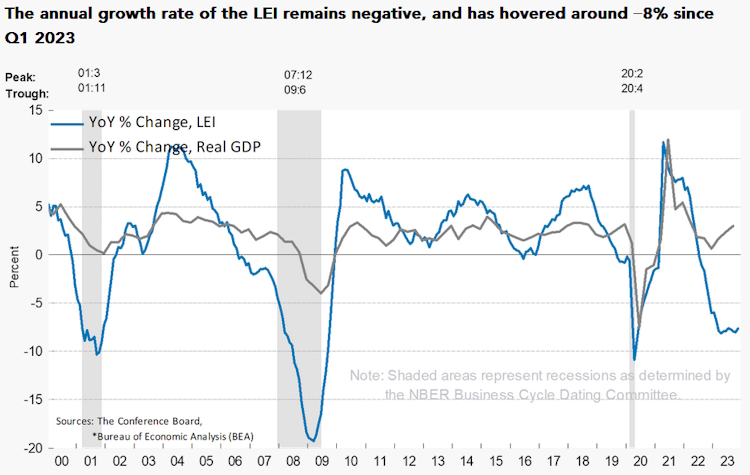

The US Leading Economic Index (LEI) continued declining in November, with stock prices making virtually the only positive contribution to the index in the month,” said Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board. “Housing and labor market indicators weakened in November, reflecting warning areas for the economy. The Leading Credit Index™ and manufacturing new orders were essentially unchanged, pointing to a lack of economic growth momentum in the near term. Despite the economy’s ongoing resilience—as revealed by the US CEI—and December’s improvement in consumer confidence, the US LEI suggests a downshift of economic activity ahead. As a result, The Conference Board forecasts a short and shallow recession in the first half of 2024. – https://www.conference-board.org/topics/us-leading-indicators

As indicated in the name, the Leading Economic Index reading tends to lead Real GDP as reported by the Bureau of Economic Analysis (BEA).

The LEI includes metrics on housing, credit, manufacturing, work hours and unemployment claims, so they are pretty comprehensive in their analysis.

If the U.S. does slip into a recession sometime between and 2024 and 2026, there’s still no reason for investors to panic.

Defined as a period of negative economic growth, recessions are a natural part of the economic cycle, occurring about every five years since World War II, and lasting only 11.1 months on average. The Covid-19 recession in early 2020 lasted just two months. The shaded, vertical bars on the chart below show every official recession since World War II.

MacroTrends S&P 500 Historical Chart

This is why we always recommend holding a year’s worth of total expenses in cash in case of job loss.

For contrarian investors who “get nervous” and stockpile cash in Bull markets as well as dividend reinvestment strategies, recessions usually provide excellent buying opportunities. Some stocks even have a track record of performing relatively well during recessions. For example, Target (TGT), Walmart (WMT), and Home Depot (HD) shares significantly outperformed the S&P 500 during both the 2020 and 2008 recessions, and our database of dividend-paying stocks has a list of just under 300 companies that have a record of increasing their dividends during recessions.

Looking at the last two non-Covid rate cycles, we would expect stocks to fall in price shortly after the Fed starts cutting rates and proceed to rebound in the 12 months following the low point of a U.S. recession. This can be especially true for stocks of large, dividend growing companies as falling prices boost their short-term yields in line with many corporate bonds of equal quality.

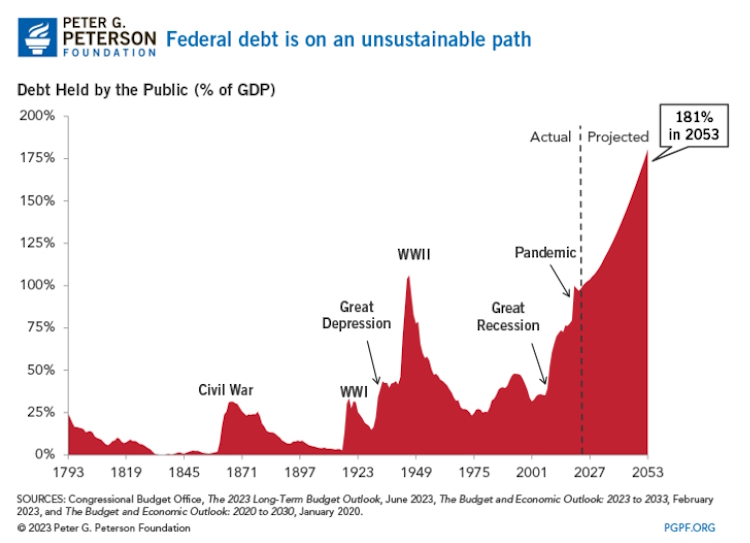

What is more concerning to us is the federal government’s likely reaction to a recession. In the spirit of “never letting a good crisis go to waste,” recessions provide an opportunity for “stimulus” spending which will only serve to increase our national debt while providing little discernable benefit to the private sector.

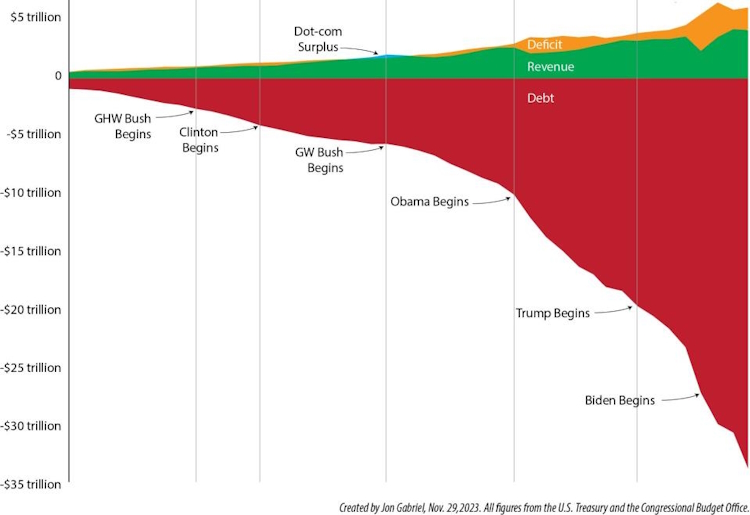

And, as Yahoo points out, it hasn’t mattered who is in office, the results have been consistent.

Our concern is that the “cure” for every crisis will create a bigger crisis than anything we have ever faced.

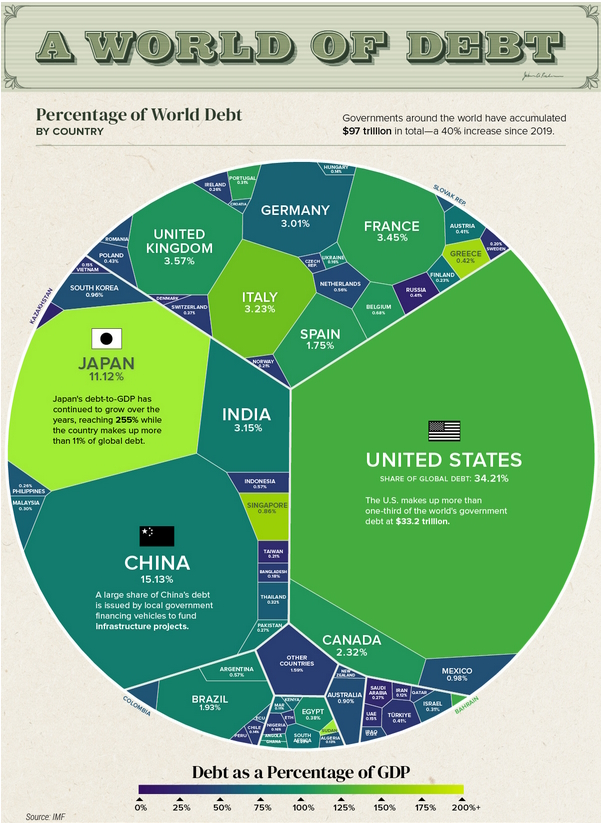

Approaching $34 Trillion, our national debt makes up 1/3 of the world’s total debt.

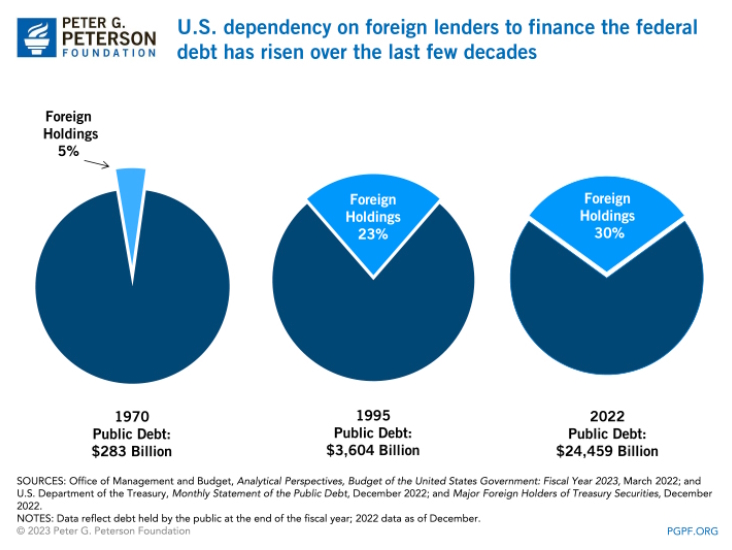

And we have grown more dependent on foreign lenders to buy our debt over time.

However, as the world is becoming more polarized, the U.S. has increasingly used international finances as a weapon against our adversaries, most recently against Russia as the Treasury Department has frozen all Russian assets that are under U.S. jurisdiction in retaliation for the invasion of Ukraine. We fear this will result in fewer foreign investors viewing U.S. Treasuries as a safe investment and there will be fewer and fewer buyers for an ever-increasing mountain of federal debt.

Even if that is not the immediate case, the U.S. produces over 25% of global GDP and there is a risk the global economy will not be able to produce enough wealth to satisfy our borrowing needs. When that happens, we have two alternatives: either get our fiscal house in order by balancing our government spending with tax revenues or print more money through the Federal Reserve to buy the debt. While we don’t like speculating, if there was one sure bet, it would probably be that the Federal Government will not cut spending. Which leaves us with option two.

The Federal Reserve Act mandates that the Federal Reserve conduct monetary policy “so as to promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates.”

Yet, in the two most recent recessions, the 2007-2009 “Financial Crisis” and the 2020 “Pandemic Crisis” the Federal Reserve took what at the time was considered unprecedented actions of purchasing large amounts of Treasury securities and mortgage-backed securities (MBSs) issued by government-sponsored enterprises and federal agencies. They did this by creating bank reserves as liabilities, which an honest economist would refer to as “printing money.”

And, like so many other things the government does in response to a “crisis,” this is now being viewed by Washington as a cool way to keep the train running.

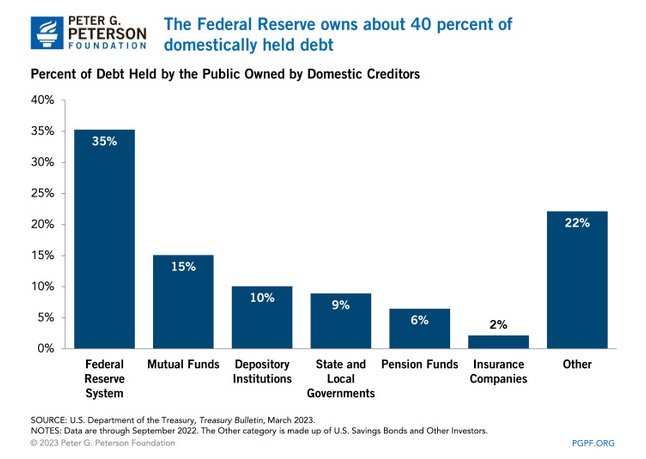

The Federal Reserve already holds a large amount of the national debt.

Unlike the other holders of US debt, the Federal Reserve’s Balance Sheet theoretically has no limits, so they have the legal ability to do this “forever.” The only limit would be a self-imposed ceiling on the amount of outstanding debt the government can issue. That limit was “temporarily suspended” until 2025, after the next election courtesy of the “Fiscal Responsibility Act of 2023.”

This is Modern Monetary Theory in all its glory, whereby we are just borrowing from ourselves.

The big flaw, besides the idea that you can “borrow your way out of debt,” is that we are not really borrowing from ourselves, but from a complex reserve banking system that we’d bet very few members of congress even understand.

Since 2009, in what was considered a good economy, the national debt grew by nearly $27 Trillion. At its current total of $33.7 trillion, the interest alone on that debt is projected to be around $1.0 trillion. So, if there is a slowdown, or even a contraction in the economy between 2024 and 2026, we could see more “stimulus” taking us close to $40 trillion. At some point, this will start to have a long-term adverse effect on the economy. We don’t know what that will look like, but we will do our best to be ready to act as the situation dictates.

In the meantime, it is very likely that we are heading into an extended sideways market where stocks go through a series of sharp advances and declines as the markets try to regain momentum after an extended uptrend like we’ve experienced since 2008. Higher interest rates, even considering the projected rate cut, will make it difficult for many “growth companies” to survive as they will have to restructure their debt liabilities due to increased interest costs. Some of that is already visible as U.S. corporate bankruptcy filings hit their highest level since 2020.

Now is not likely the time to load up on speculative companies.

Add to that a growing list of other risks — two major wars (Ukraine and Israel), heightened geopolitical tensions, and an enormous number of national elections around the world (including the U.S.) that could dramatically change the global economy in unexpected ways—and you have a strong case for owning income producing assets. In the case of stocks, that means companies in boring sectors of the economy that are better positioned to weather economic turmoil.

This doesn’t mean just large-cap companies, but it does mean companies with strong balance sheets, pricing power, and sustainable profit margins. While there are companies outside the U.S. that meet these criteria, you still find most of them here. Almost in spite of ourselves, we still have the largest economy, the most liquid markets, and some of the world’s best businesses.

Penultimately, I will be speaking at the Oxford Club’s 26th Annual Investment University Conference, February 26-29 in Ojai, California. If you are planning to attend, please let me know so we can plan to meet up while you are there

As always, we welcome your phone calls and emails. We are always watching the markets as well as those events that can influence them and will continue to research the best ways to help you achieve your financial goals with the lowest relative levels of risk.