When asked for his advice, famed investor Warren Buffett, the “Oracle of Omaha,” suggests that buying index funds is the best option for most investors. There are several reasons for this. We’re guessing the biggest one is the average investor severely underperforms the broader market indices.

Most investors do not have the discipline it takes to stick with a strategy under the constant bombardment of financial news triggering extreme fear or extreme greed.

Since 1984, independent investment research firm Dalbar Inc. has published an annual QAIB: Quantitative Analysis of Investor Behavior report. If you’ve followed Dalbar’s research over the years, you’d be well aware that one consistent theme keeps cropping up.

The set of longer-term data analyzed in these QAIB reports clearly shows that people are more often than not their own worst enemies when it comes to investing.

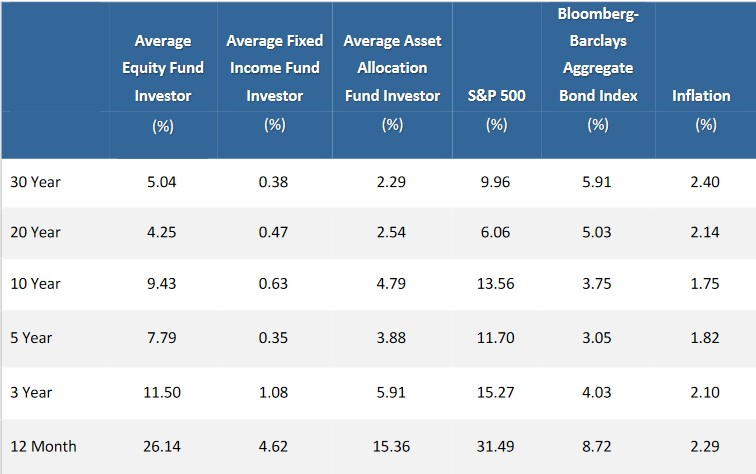

Source: DALBAR 2020 QAIB Report for the period ending: 12/31/2019

Given this information, one can hardly blame Buffett for making a safe recommendation, especially when he does not know anyone’s personal financial needs or even why they’re making an investment at all.

For instance, if you are investing for retirement and expect your investments to provide for your living expenses once you quit working, simply investing in an index fund may not be the best strategy.

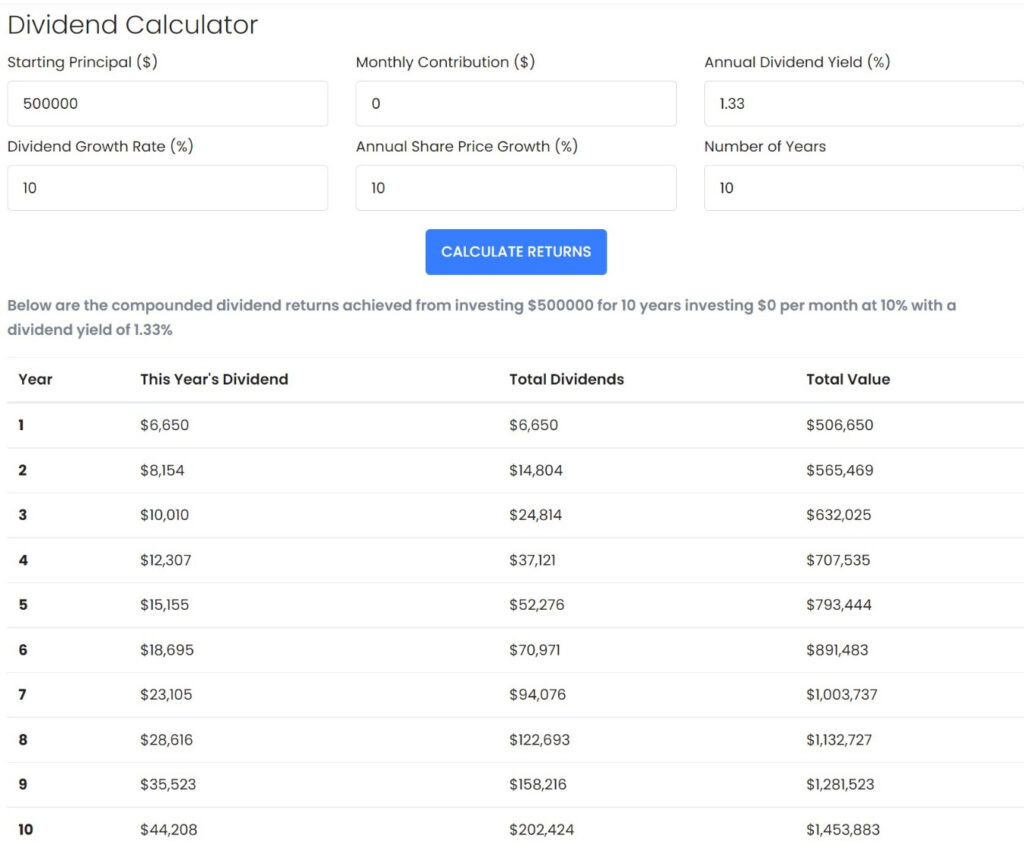

Using the S&P 500 Index ETF as a reference, we plugged the numbers into a Dividend Reinvestment Calculator using the following assumptions:

Starting Investment: $500,000 in a traditional IRA assuming ten years to retirement

Current Dividend Yield: 1.33%

Annual Dividend Growth Rate: 10%

Annual Share Price Growth: 10% (30 year average)

Looking at the Total Value column below, we can see that you certainly can build a nice nest egg by the time you retire based on the above assumptions. The second column below adds an average social security payment of $2500 per month to the total, showing that the investor could begin their first year of retirement with an income of about $74,000 before taxes. Remember that IRA withdrawals are taxed as regular income so if they were retiring today that would be 12% for married individuals filing jointly.

How does that compare with a cash-flow biased strategy?

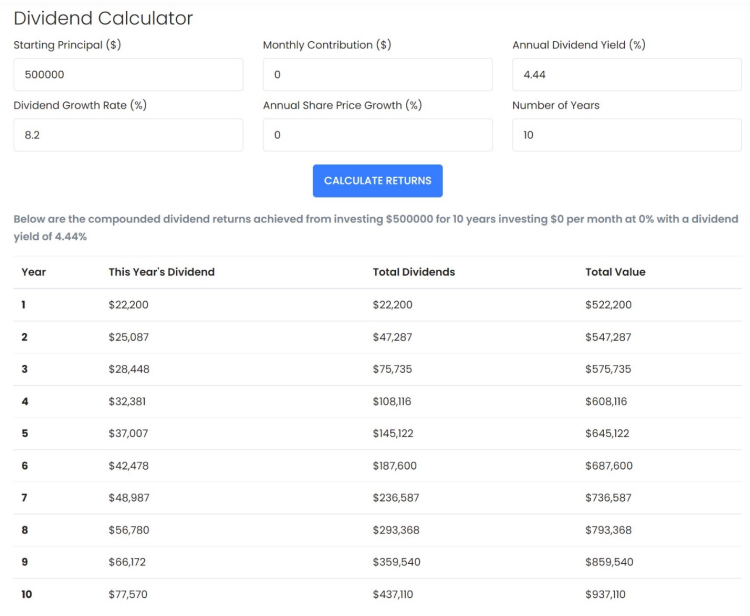

For comparison, we took a published Compound income portfolio that we track with the following assumptions:

Starting Investment: $500,000 in a traditional IRA with ten years to retirement

Current Dividend Yield: 4.44%

Annual Dividend Growth Rate: 8.2%

To emphasize that this strategy is dependent on fundamentals and not share prices, we assumed the Annual Share Price Growth was zero.

The results below beg the question, who is better off?

Looking at the last column, on a price basis, investing in the index with average price increases will give you a larger portfolio. That is very good if you need to sell portions of it to pay your bills.

However, if we look at the second column, we see that the compound dividend portfolio will be providing around $77,000 in dividend income, which is more than the SPY investment plus social security combined. In fact, add in social security and though it’s substantially smaller than the index portfolio, this method provides nearly $100,000 per year in income.

Depending on your budget, some of the funds could continue to be reinvested to produce even larger cash flows in the future.

There’s an old saying in statistical analysis: “no one achieves average.” These are models based on a set of an assumptions. The S&P ETF won’t gain 10% per year but will likely lose 10% one year and gain 20% in another. Similarly, the individual stocks in the Compound

Dividend portfolio won’t stay at the same price over a ten-year period. In fact, the entire portfolio is up nearly 16% year to date. So, we won’t always be able to reinvest our dividends at bargain prices.

While the absolute results will likely be different for each strategy over the next ten years, the relative performance of one strategy versus the other will likely be close to the model projections.

As of June 2021, 70% of Buffetts’ $320 Billion portfolio is in five stocks (AAPL, BAC, AXP, KO and KHC), all of which pay dividends currently ranging from $0.84 per share to $1.74 per share. Whether the stock market is up or down, those five holdings alone will provide Warren’s company with approximately $3.1 Billion. That’s enough to pay the bills including Warren’s salary and benefits.

Is this the best way to invest?

You can argue both sides. Buffett’s stock, Berkshire Hathaway (BRK.A), has failed to outperform the markets for a while and he is regularly mocked by financial journalists for having “lost his touch” when it comes to the markets.

Still, we really doubt that he lost much sleep over paying his bills during the 2008-2009 bear market or the Covid Crash of 2020.