Q3 2019 – The Trend is Still Up

There was a quirky show in the late 1980’s titled “Twin Peaks”, where one of the main characters, a young FBI investigator, was known to say,

“Every day, once a day, give yourself a present.”

While I found this line of thinking to be too expensive for my lifestyle, it is essential for us to find something to celebrate and associate it with our activities, schedules and responsibilities. In this way, just like that once-in-a-while, great hit I make on the golf course, these positives keep us moving forward through the valleys on our journey.

With the idea of seeking something to celebrate in the face of whatever life throws at you, let’s go to the markets.

With all the headlines about recessions, tariffs, interest rates, impeachment, air strikes and Iran, no one would blame you if you were afraid to look at your investments. But the truth is that, despite the ongoing volatility, and this is a volatile market, we sit here today just a few percentage points below the all-time highs ever reached by the stock market. In fact, on the first day of the quarter, the S&P 500 set a new closing record.

In the graph above, the middle line is a trend line and the two outside lines form a channel that is one standard deviation from the trend line. These tools make great visual aids for demonstrating market volatility.

Overall, our portfolios have held up well through the volatility, with quality dividend-paying stocks, real estate investment trusts (REITs) and even quality Master Limited Partnerships, (MLPs) attracting investment when the stock market gets choppy. Now this is not to say that these investments will not experience a price drop in a bear market, history shows otherwise. But, because the purpose of these investments is to derive income, a technical, not fundamental, drop in price will typically be an investment opportunity and money flowing to any investment will eventually lead to a rise in price.

As the trend is still up, our focus is maintained on those investments that will perform well in uptrends and watching out for any potential catalysts which may cause for a substantial short-term trend reversal. We refer to those issues as the things that keep us up at night.

Recession Watch

While we were not able to find reliable data about the number of news stories warning about a potential recession, they seemed to hit a crescendo in August coinciding with the volatility we saw in the market. Key drivers of many of these stories were the ongoing inversion of the yield curve as well as the impacts a prolonged or escalating trade war with China would have on the economy.

Almost on demand, Bloomberg published a rather well put together, data driven article regarding the current state of the economy.

Without republishing the whole thing, we highlight the following:

The Bloomberg Economic Surprise Index has reached an 11-month high after four indicators released Thursday, including existing home sales and jobless claims, each surpassed expectations. The gauge continued to advance after swinging to positive from negative on Tuesday for the first time this year. The data also pushed a similar measure produced by Citigroup Inc. to the highest level since April 2018.

In addition, an industry report on August existing home sales sailed above all forecasts following a report Wednesday showing the strongest pace of housing starts since 2007, signaling that residential construction may add to economic growth in the third quarter for the first time since the end of 2017.

Last quarter, we discussed The Conference Board Leading Economic Index® (LEI) for the U.S. and the readings we were getting from that. Again, from Bloomberg:

Elsewhere, the unchanged reading on the Conference Board’s index of leading economic indicators — a barometer of future growth — compared with projections for a decline.

Based on the data, while we may see some slowing in the growth of the economy, we are still seeing growth. A recession is, of course, a contraction of economic activity, not a slowdown, and; as we have asserted in prior letters, recessions are usually caused by negative economic events. Without a discernible catalyst to retard economic activity, there is no reason at this time for the economy not to keep moving forward, although possibly at a different, perhaps lower, rate of growth.

We are not alone in our position. In a recent video titled “Expansions don’t Die of Old Age”, Steven Dover, the Head of Equities for Franklin Templeton, a major investment management firm, notes that the record for the longest economic expansion is not 10 years or even 15 years, but now over 20 years in the country of Australia, which likely coincides with their proximity to the Asian continent, particularly China.

He then makes the point that, at least for the foreseeable future, interest rates have stopped rising while inflation remains tame by historic standards which is bullish for stocks, and; while both China and the Eurozone are experiencing tepid growth, it is still growth.

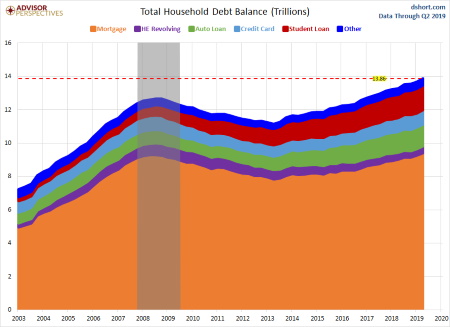

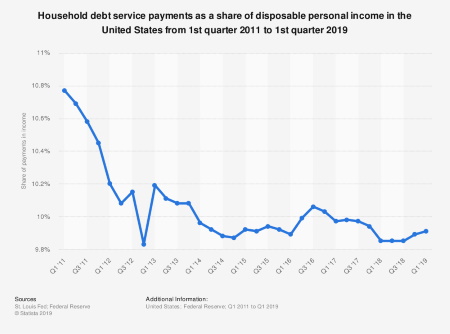

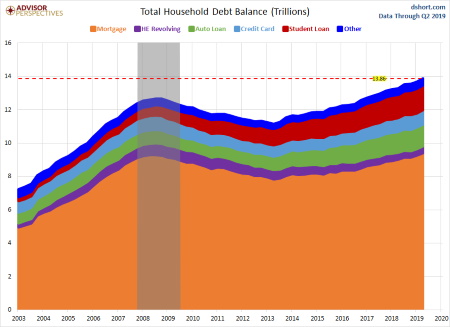

One other piece of data that gave us a positive surprise was household debt service payments as a share of disposable personal income. As ongoing observers of the economy, we are often reminded that total household debt has reached record levels as depicted by the chart below.

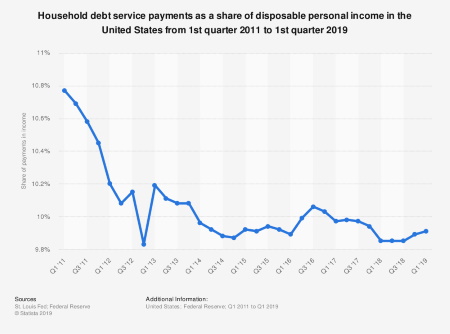

But another chart, courtesy of Statista.com, gives a much different perspective on household debt. The chart below depicts the debt service payments of household debts as a percentage of disposable personal income.

As you can see, as a percentage of disposable income, debt service payments have been trending downward. While an overall growth in debt, especially auto and student loan debt is always troubling and ill advised, the growth in personal disposable income seems to be keeping up with the debt load.

This aligns with the increases we observe in consumer spending data, which is seen as a key driver of economic performance.

Interest Rates and the Yield Curve

As noted above interest rates, as driven by the Federal Reserve’s monetary policy, have stopped increasing for the foreseeable future. At its latest policy meeting on Wednesday, the Federal Reserve cut interest rates by 25 basis points to a new target range of 1.75% to 2.00% and telegraphed a strong likelihood of one more rate cut by the end of the year.

Not only did the Fed cut rates, but their members actually increased their expectations for the domestic economy. An article posted on the Yahoo finance site reported:

Despite all the noise, the committee’s economic projections on components of the U.S. economy paint a brighter picture domestically. Policymakers raised their projections on U.S. GDP growth, with the median member now projecting GDP growth of 2.2% in 2019, a notch up from the median projection of 2.1% in the last dot plot release in June.

Much of this is buried in the cacophony of outrage over President Trump’s criticism of Fed policy and his call for interest rates below zero.

In theory we can make the point that interest rates on U.S. government debt should be lower than that of other issuing countries. If we think about the concept of credit risk, it would make perfect sense that the strongest financial entities would be able to issue debt at the lowest rate of interest, and vice versa.

However, it is our belief that negative interest rates are generally the result of fiscal policies that have been a wet blanket on most of the world’s largest economies for well over a decade. Governments that already place high taxes and burdensome regulations on their industries and populations have no other means of getting the consumers to spend whatever money they have left than to make it more costly for them to store it in a bank. They believe that over the long run, doing this will stimulate growth and more importantly, raise inflation, which is the only way most countries will ever deal with their ballooning levels of national debt.

Since interest rates now seem to be a tool for financial manipulation, it is impossible to apply economic principles to the current environment. We would at least hope that Chairman Powell has learned the lesson that you cannot play catch-up with rates as he tried to do over the last two years. The Fed started aggressively raising rates while reducing the size of its own balance sheet in the hope of rebuilding its ability to deal with the next downturn. As we stated back then, the Fed was on a course to be the cause of the next downturn.

Many investors, particularly retirees, use government debt, particularly 10-year Treasury Bonds, as important components of investment portfolios. Therefore, driving interest rates down to keep up with the rest of the world’s central banks could have adverse economic consequences on a substantial portion of the US population. The Federal Reserve must walk a very narrow tight rope in trying to balance its policies across a diverse range of economic needs.

In the short term (as noted above in the Recession Watch section) the current pause in interest rate increases is already stimulating the housing market and will continue, rightly or wrongly, to drive investment in higher risk assets such as stocks, corporate bonds and REITs.

The yield curve made headlines several times this quarter as, along with China trade, the purported reason for a market sell-off. However, many financial observers are coming around to a conclusion like ours, that U.S. Treasuries are one of the few places left to store cash.

According to CNBC:

About $15 trillion of government bonds worldwide, or 25% of the market, now trade at negative yields, according to Deutsche Bank. This number has nearly tripled since October 2018. Historically, people give the government their money, instead of spending it, with the promise of being paid back, with interest. Now, governments are essentially getting paid to borrow money, as people become increasingly desperate for a safe haven for their wealth.

In a scenario like this, it’s just logical that U.S. Treasuries – which many investors view as the ultimate “safe haven” apart from gold, would be in strong demand.

There are very few laws in economics, but one that has stood the test of time is the law of supply and demand. As demand for positive-yielding treasuries increases, the price of those bonds will go up which means that yields will go down. In the CNBC article, which was published in August 2019, the writer notes:

The yield on the benchmark 10-year Treasury note, was lower at 1.595% on Wednesday, the lowest level since October 2016 and 40 basis points lower than it was one month ago. The yield on the 30-year Treasury bond also dropped as low as 2.164%, near an all-time low hit in 2016.

With 10 and 30 year Treasury bond yields dropping so precipitously, while short term yields, which are more highly impacted by Fed policy, were staying steady, or slightly increasing, it should be no surprise that we would see an inversion between the short- and long-term rates.

This is not to say that an interest rate inversion is no longer a harbinger of bad economic news. The prolonged negative rates we are seeing in major economies around the world including India, New Zealand, Thailand, Japan and the European Union (ECB) are a reaction to the ongoing weak economic data coming from those regions. At some point, these weak global economies will have an impact on ours, potentially to the point of contraction. Even if it’s mild, given the lingering memory of the 2008-2009 crash, a market over-reaction is not inconceivable.

China Trade

The on-again, off-again negotiations between China and the US are on again as the two sides have agreed to resume talks in October. In September, President Donald Trump delayed the next round of tariff increases on Chinese goods until after trade talks that are scheduled for early October while the Chinese announced that they will exempt US soybeans, pork and some other agricultural products from additional tariffs according to reports in The Business Times (September 14, 2019).

Public brinksmanship by either side is often met with a knee-jerk sell-off in the US markets, while acts of “good faith” have an opposite and often equal affect. In each case, the impact is short lived and doesn’t even show up on the daily stock index charts.

We continue to see evidence that the tariffs have exasperated Chinese economic ambitions, however, this is a government that can afford to play the long game if they can keep their citizens at bay.

If they can maintain control, they are more likely to wait until the 2020 elections in hope of a more agreeable administration taking over.

India – Pakistan

In a different time, the threat of nuclear war would dominate headlines and the world would be actively campaigning to bring about a peaceful resolution between the two sides. To our surprise, there were few headlines recently as the conflict between India and Pakistan spilled over into the annual U.N. General Assembly that took place in New York City in September.

As reported in the Albany Times-Union, Pakistan’s Prime Minister, Imran Khan, pointedly accused Indian leader Narendra Modi of “cruelty” in the Muslim-majority region of Kashmir and warned of catastrophe if the two nuclear-armed nations tumbled into war. Saying the United Nations had a responsibility for robust involvement in the problem, he said inaction would produce bad results.

Modi, in his address an hour earlier, took a starkly different approach: while raising the specter of terrorism — a nod to the reasons he cited for clamping down on the region, angering Pakistan — he never uttered the word “Kashmir” and focused on India’s economic and infrastructure development.

The two countries have been locked in a standoff since Aug. 5, when Modi stripped limited autonomy from the portion of Kashmir that India controls and it was hoped that the move toward some type of resolution could be revived during the U.N. meeting. However, it looks like the anticipated progress fell way short of even the most modest goals.

While the threat of nuclear war is still a long way off, the potential for escalation of armed conflict is very real.

North Korea and Iran

Like many, we are disappointed that the U.S. has not been able to bring North Korea closer to a more peaceful position in the world. Just like “Lucy with the football”, every time we get close to the winning kick the ball is pulled away.

There are several theories offered for this. They range from North Korea being nothing but a puppet regime for China to the North Korean leader, Kim Jong Un, being fearful of giving up totalitarian control and placing his position and his life at risk. We may someday learn what is really going on in this country, but it is important to remember that these regimes can last a very long time, especially if they are being propped up by economically stronger trade partners.

Iran presents a rather interesting situation. A decade ago, the recent attack on Saudi Arabian oil facilities, which have been attributed to Iran, would have sent the markets into a tailspin. But now that the United States is a net exporter of oil, it produced only a slight and temporary uptick in oil prices and has had negligible impact on the US markets.

Like North Korea, Iran’s regime is also propped up by more economically stable trade partners, including the European Union whose member countries have signed numerous trade agreements with Iran since the signing of the July 2015 nuclear deal. Are they dealing with Iran because they believe the threats we hear about are overblown, or do they hope that by increasing economic cooperation, they will be able to persuade the regime to play a more constructive role in the Middle East, especially in Syria, and to engage with the Gulf states?

These issues, Pakistan and India, North Korea, and Iran, present risks based on their abilities to create instability throughout the regions they inhabit. However, we believe that this type of risk is nothing new and is already priced into the markets. If, on the other hand, there was a significant break-through, meaning lasting agreements that were both enforceable and verifiable, that would be an unexpected positive development.

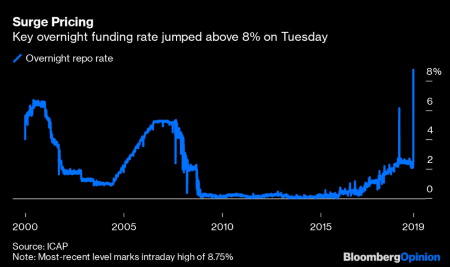

Strange Happenings in the Repo Market

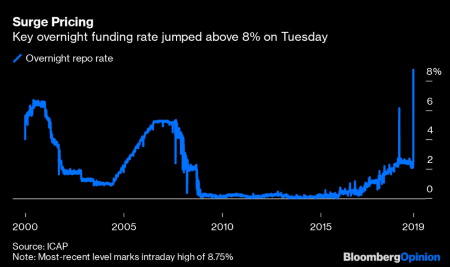

In what was a disturbing reminder of the 2008 – 2009 credit market upheaval, the New York Fed was forced to intervene in money markets due to a sudden surge in short-term borrowing costs in the morning of September 17th.

As reported by Bloomberg:

The Federal Reserve took action to calm money markets, injecting billions in cash to quell a surge in short-term rates that was pushing up its policy benchmark rate and threatening to drive up borrowing costs for companies and consumers…

Money markets saw funding shortages Monday and Tuesday, driving the rate on one-day loans backed by Treasury bonds – known as repurchase agreements, or repos – as high as 10%, about four times greater than last week’s levels, according to ICAP data.

More importantly, the turmoil in the repo market caused a key benchmark for policy makers – known as the effective fed funds rate – to jump to 2.25%, an increase that, if left unchecked, could have started impacting broader borrowing costs in the economy.

What is the Repo market?

The Repo market is not really a place, but a financial system that allows participants that own lots of securities (usually Treasury bonds) but are short on cash to cheaply borrow money. And it allows parties with lots of cash to earn a small return while taking little risk, because they hold the securities as collateral for the loan. A key feature is that the cash borrower agrees to repurchase those securities later, often as soon as the next day, for a slightly higher price, hence the name “repo”. That difference in price determines the repo rate.

Think of someone who may be debt free with $100,000 in the bank but needs $2000 cash to make a transaction and has found that the local ATM is out of order. That person may pledge their car to someone who has the cash in order to make the $2000 transaction and then, when the bank is open, withdraw the cash from their account and pay off the loan, releasing the lien on their car.

The financial media pointed to several potential causes for the sudden dearth of liquidity:

These include the Fed’s recently concluded quantitative tightening (“QT”) program – which saw the Fed shrink its balance sheet by more than $1 trillion over the past couple of years… the dramatic increase in debt issuance by the U.S. Treasury this year… post-financial crisis rules requiring banks to hold greater reserves… and even Monday’s corporate-tax payment deadline, among others.

There are several good articles about this published by several credible organizations and each one provides one or more reasonable explanations as to the cause. However, the reality is no one is really sure why it happened.

Still, the consensus among most financial professionals – including the Fed itself – is that this is merely a temporary problem that can be easily corrected by the Fed’s short-term interventions. We will keep an eye on this.

In Summary

As the title suggests, our approach is to continue to invest in the uptrend until we have strong confirmation of a trend reversal by the market. The economic backdrop remains favorable. We have low inflation, low interest rates, cheap energy, a strong dollar, wages at a 10-year high and unemployment at a half-century low. Yes, second quarter corporate profit growth slowed a bit from the first quarter. But the earnings outlook is still positive.

Until things change, the trend is still our friend.

Read More

During their initial training, financial advisors are taught to ask about a client’s goals for incorporation into their personal financial plans. Some of these goals can be “retirement at a certain age”, “a comfortable retirement”, “putting the kids through school”, “a condo in Aspen, Florida, Spain”, etc.

During their initial training, financial advisors are taught to ask about a client’s goals for incorporation into their personal financial plans. Some of these goals can be “retirement at a certain age”, “a comfortable retirement”, “putting the kids through school”, “a condo in Aspen, Florida, Spain”, etc. Therefore, prioritization must always favor needs over wants. While that may seem self-evident as you read this, I can assure you that many clients have a difficult time discerning needs from wants and an even harder time accepting the need to prioritize them, especially during times of financial abundance. Once the list has been divided into wants and needs, the prioritization can then take place starting with needs. In our Foundations of Wealth model, we define three levels of wealth that a client can attain:

Therefore, prioritization must always favor needs over wants. While that may seem self-evident as you read this, I can assure you that many clients have a difficult time discerning needs from wants and an even harder time accepting the need to prioritize them, especially during times of financial abundance. Once the list has been divided into wants and needs, the prioritization can then take place starting with needs. In our Foundations of Wealth model, we define three levels of wealth that a client can attain: Achieving a financially comfortable state is the longest and most difficult goal to reach. The reason for this is that it is usually the hardest state to define. Financial comfort for a single person making a six-figure income is much different than a two-income family with three kids, and as we have either seen or experienced ourselves, single people can become married and childless couples can become parents in a very short period of time. On the flip side, married couples can become single through death or divorce and one-child families can become 4-child families through second marriages or similar events.

Achieving a financially comfortable state is the longest and most difficult goal to reach. The reason for this is that it is usually the hardest state to define. Financial comfort for a single person making a six-figure income is much different than a two-income family with three kids, and as we have either seen or experienced ourselves, single people can become married and childless couples can become parents in a very short period of time. On the flip side, married couples can become single through death or divorce and one-child families can become 4-child families through second marriages or similar events.