There is Still Time to Fund Your 2015 IRA

Many of us view April 15th*, the date by which we must file our tax returns for the preceding year, as an important deadline. However, for all of us, it actually represents a much more significant deadline:

Tax Day is the last day that we can make our 2015 contributions to our Individual Retirement Accounts.

Even if you have a 401(k), you can still have either a Traditional or Roth** IRA to make the most of your retirement savings. Your contributions may also be tax-deductable, which means they could reduce your taxable income and, therefore, the amount of tax you have to pay. If that’s the case, then each year you make a contribution, you could reduce your income tax and any gains in your account in your account will grow tax deferred.

The earlier you start saving with an IRA, the sooner you can start reaping the benefits of compounding and increasing your potential retirement income. Using the financial calculators at Bankrate.com****, you can see the potential results.

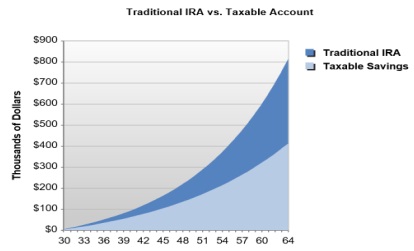

Results Summary for 30 Year Old Investor Contributing $5,500/Year

An individual age 30 with an initial $5,500 contribution and a $5,500 contribution every year thereafter can potentially accumulate a significant amount of money for retirement by age 65.***

- Starting balance: $0

- Contribution for 2015: $5,500

- Total contributions by age 65: $192,500

- IRA total before taxes: $813,524

- Total for an equivalent taxable account: $413,051

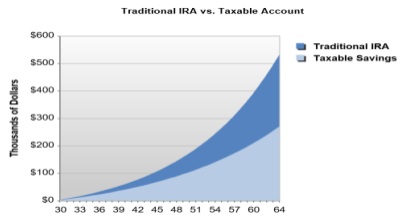

Results Summary for 30 Year Old Investor Contributing $300/Month

Even if you cannot contribute the maximum allowable to your IRA, you can still make substantial progress toward retirement with smaller amounts. For example, even with a contribution of $300 per month, the benefits of tax deferred compounding become readily apparent.***

- Starting balance: $0

- Contribution for 2015: $3,600

- Total contributions by age 65: $126,000

- IRA total before taxes: $532,488

- Total for an equivalent taxable account: $270,361

Opening an account with Summit Investment Management is simple and easy.

You can either open an account online and access portfolios designed to align with your individual risk profile or you can contact us for a New Client Enrollment kit that gives you access to our advisors for a more personal experience.

Either way, you can benefit by investing your retirement savings with an experienced investment team that actively manages your portfolios making investment decisions that are based on our highly disciplined, rules-based selection process.